-

What is a cross-border transaction?

A cross-border transaction involves a transaction between a Malaysian buyer and a foreign supplier, or vice versa. This includes the exchange of goods or services between entities located in different countries.

-

Who is a foreign supplier in cross-border transactions

Foreign supplier refers to any supplier operating outside of Malaysia / not established in Malaysia, including non-Malaysian individual. Conversely, foreign buyer refers to any foreign person whom acquires goods and/or services from Malaysia.

-

What are the different types of cross-border transactions?

-

- Goods sold or services rendered by a foreign seller (supplier) to a Malaysian purchaser (buyer).

- Goods sold or services rendered by a Malaysian seller (supplier) to a foreign purchaser (buyer).

Goods Sold or Services Rendered by Foreign Seller to Malaysian Purchaser

Figure 1.1 – Current transaction flow between Foreign Seller (Supplier) and Malaysian Purchaser (Buyer)

-

Under the e-Invoicing system, what should a Malaysian purchaser do when purchasing goods or services from a foreign seller?

When a Malaysian purchaser acquires goods or services from a foreign seller, the foreign seller issues an invoice, receipt, or bill to record the transaction.Since the foreign seller is not required to comply with Malaysia’s e-Invoicing system, the Malaysian purchaser must issue a self-billed e-Invoice to document the expense for tax purposes.

-

Who assumes the roles of supplier and buyer in this scenario?

-

- Supplier: Foreign Seller

- Buyer: Malaysian Purchaser (assumed the role of Supplier to issue a self-billed e-Invoice for proof of expense)

-

What are the deadlines for issuing self-billed e-Invoices for cross-border transactions?

-

- For imported goods:

The self-billed e-Invoice should be issued by the end of the month following the month of customs clearance.

- For imported services:

The self-billed e-Invoice should be issued by the end of the month following the EARLIER of either the payment made by the Malaysian purchaser or the receipt of the invoice from the foreign supplier.

-

Is service tax applicable in self-billed e-Invoices for cross-border services?

Yes, if service tax is applicable to imported taxable services in accordance with the relevant SST legislation, the taxpayer is required to include the service tax amount in the self-billed e-Invoice.

-

Does the Malaysian purchaser need to share the self-billed e-Invoice with the foreign seller?

No, the Malaysian purchaser is not required to share the self-billed e-Invoice with the foreign seller. The e-Invoice serves as proof of expense for tax purposes within Malaysia.

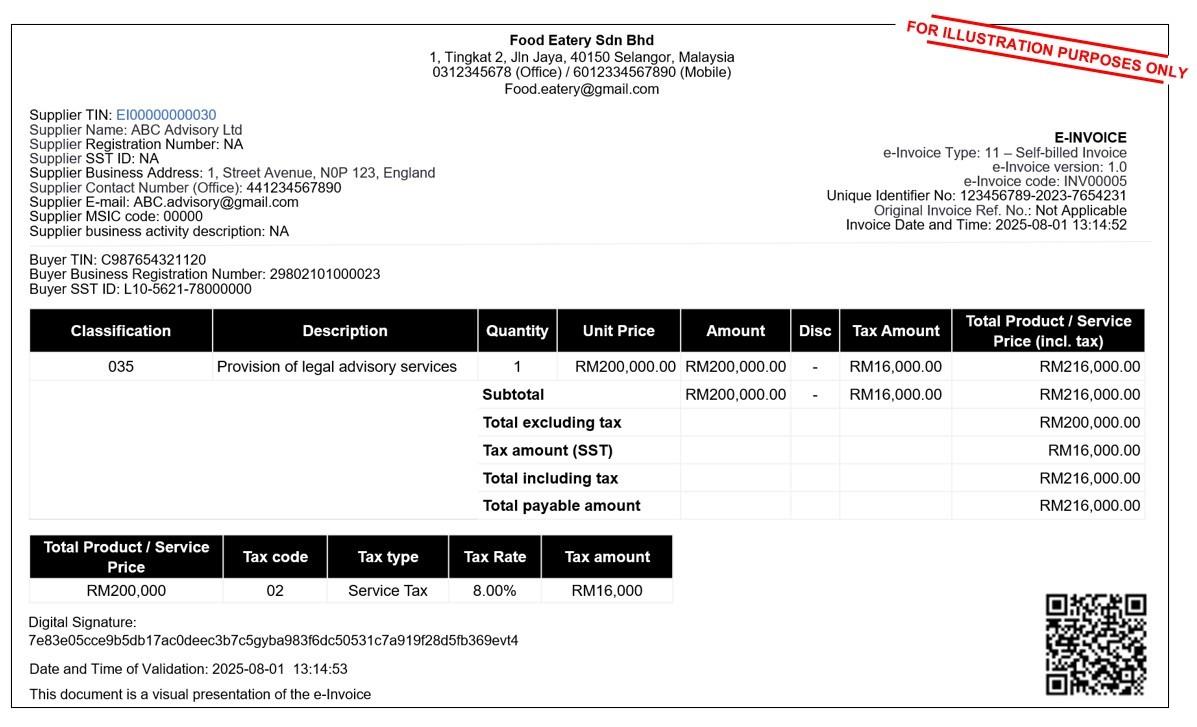

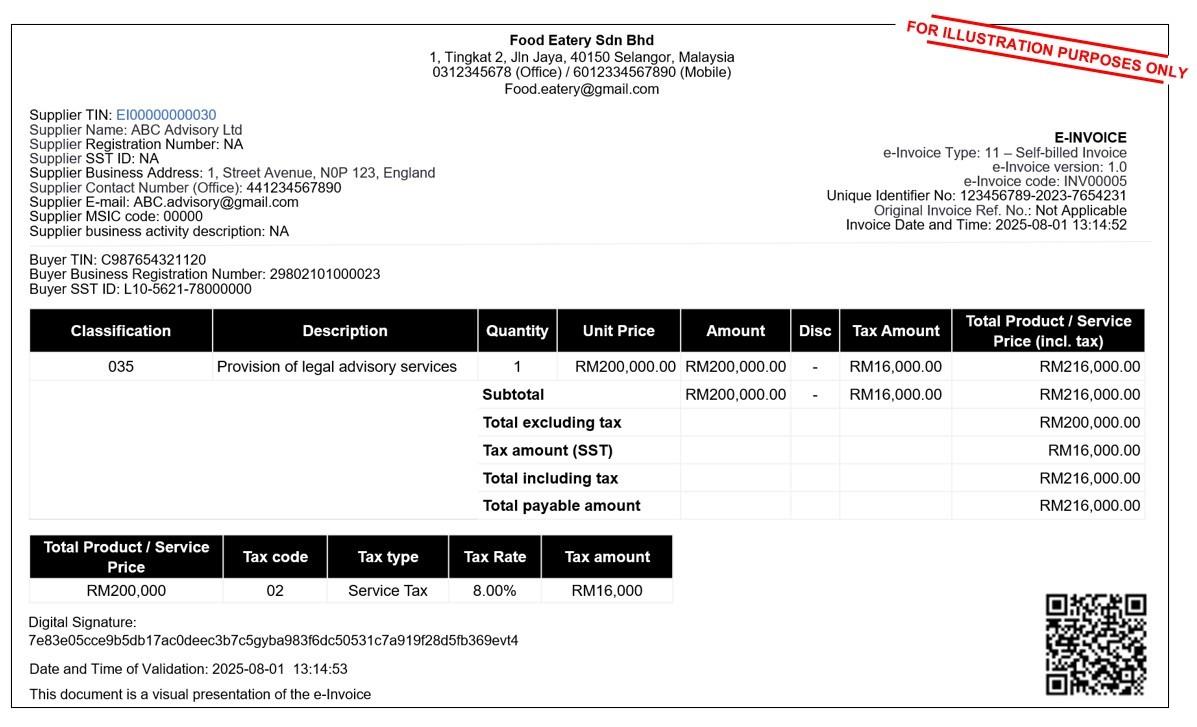

Figure 1.2 – Example of visual representation of validated self-billed e-Invoice for transaction with foreign supplier in PDF format

Goods Sold or Services Rendered by Malaysian Seller to Foreign Purchaser

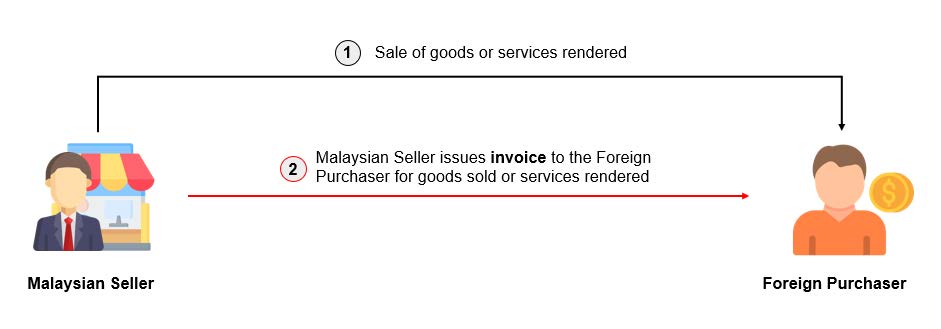

Figure 1.3 – Current transaction flow between Malaysian Seller (Supplier) and Foreign Purchaser (Buyer)

-

What is the current practice for invoicing by Malaysian sellers to foreign purchasers?

Currently, Malaysian sellers issue an invoice, bill, or receipt to foreign purchasers to record transactions such as the sale of goods or the provision of services.

-

What changes will occur upon the implementation of the e-Invoicing system?

With the implementation of e-Invoicing, Malaysian sellers will be required to issue e-Invoices to foreign purchasers to record the income from such transactions.

-

Is there a way to better understand the mechanism, implementation and transactions with agents, dealers and distributors for e-Invoice?

Yes, you can gain further insights into the e-Invoice mechanism and workflow by referring to the official guidelines published by the Inland Revenue Board of Malaysia (IRBM).

You may also consider attending e-Invoice training courses for detailed guidance.

For more information or to register, please visit the contact link below: ANCGroup_E-Invoice Courses Contact.

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.