October 18, 2024

October 18, 2024

Categories

Do you like it?

October 18, 2024

October 18, 2024

Categories

Do you like it?

October 4, 2024

October 4, 2024

Categories

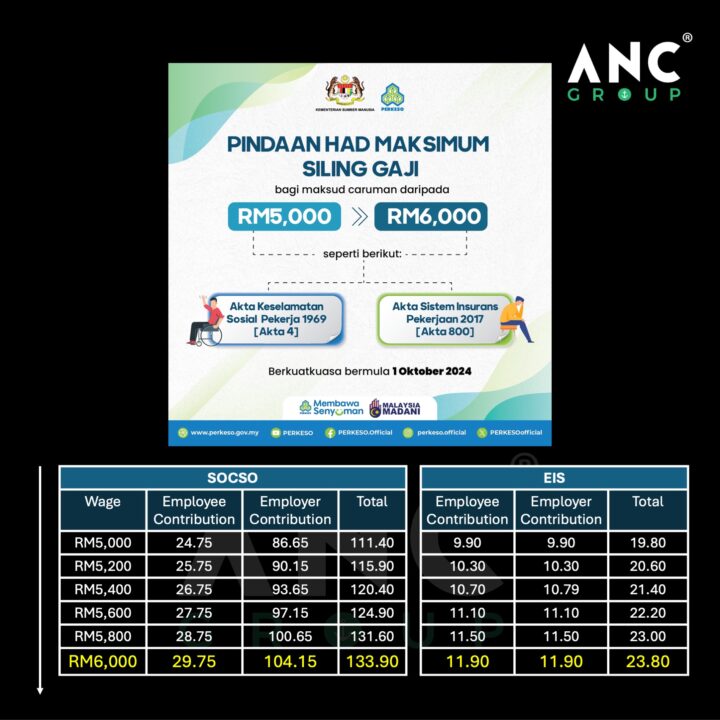

⚓️ SOCSO 社險 和 EIS 就业保险 上限额正式从 原有的 RM5,000 提高至 RM6,000。 . 这项提案终于在2024年10月1日,正式生效。这表示2024年10月的薪金开始,将会缴纳更多的 SOCSO 社险 […]

Do you like it?

October 4, 2024

October 4, 2024

Categories

With effect from 1 October 2024, SOCSO and EIS Contribution ceiling has been increased from […]

Do you like it?

October 4, 2024

October 4, 2024

Categories

⚓ 2024年9月30日,马来西亚政府正式发布《所得税(电子发票)规则 2024》,为电子发票的发行提供了全面的指南。 . 主要亮点包括: . 1️⃣ 强制性电子发票的门槛将基于2022年财务报表中的营业额确定。 . 2️⃣ 电子发票规则不适用于: – 外国外交机构 – 不从事商业活动的个人 […]

Do you like it?

October 4, 2024

October 4, 2024

Categories

⚓ On September 30, 2024, the Malaysian government officially gazetted the Income Tax (Issuance of […]

Do you like it?

September 23, 2023

September 23, 2023

Categories

PUBLIC RULING NO. 11/2019 : Benefits in Kind The objective of PUBLIC RULING NO. 11/2019 […]

Do you like it?

September 23, 2023

September 23, 2023

Categories

PUBLIC RULING NO. 11/2016 : TAX BORNE BY EMPLOYERS The objective of PUBLIC RULING NO […]

Do you like it?

September 23, 2023

September 23, 2023

Categories

PUBLIC RULING NO. 9/2016 : Gratuity The objective of this PUBLIC RULING NO. 9/2016 is […]

Do you like it?

May 26, 2023

May 26, 2023

Categories

PUBLIC RULING NO. 5/2019 : Perquisites From Employment The objective of this PUBLIC RULING NO. […]

Do you like it?

May 25, 2023

May 25, 2023

Categories

Finance Bill 2023 : What are the highlights and benefits to us? This TaxLetter is […]

Do you like it?

May 8, 2023

May 8, 2023

Categories

Revised Budget 2023: What are the highlights and benefits to us? Themed Developing A Civil […]

Do you like it?

March 29, 2023

March 29, 2023

Categories

Public Ruling No. 6/2022 – Accelerated Capital Allowance The objective of Public Ruling No. 6/2022 […]

Do you like it?

March 29, 2023

March 29, 2023

Categories

Public Ruling No. 7/2022 : Venture Capital Tax Incentives The objective of Public Ruling No. […]

Do you like it?

March 29, 2023

March 29, 2023

Categories

Taxation of Resident Individual Part II – Computation of Total Income and Chargeable Income This Public […]

Do you like it?

March 13, 2023

March 13, 2023

Categories

Tax Treatment on Real Property Gains Tax (“RPGT”) The Real Property Gains Tax Guidelines 2023 […]

Do you like it?

March 13, 2023

March 13, 2023

Categories

Tax Treatment in Relation to Foreign Source Income Received in Malaysia (Amendment) The contents of […]

Do you like it?

March 13, 2023

March 13, 2023

Categories

Tax Treatment of Accrued Interest or Profit Payable to Bank or Financial Institutions during the […]

Do you like it?

March 13, 2023

March 13, 2023

Categories

Income Tax (Relocation of Provision of Services Business Incentive Scheme) Rules 2022 In order to […]

Do you like it?

March 13, 2023

March 13, 2023

Categories

Minimum Transfer Pricing Documentation Template Date of Publication: 11 November 2022 The objective of the […]

Do you like it?

![FW1289389 PTJ03 24022023 PM lpr – Finance Bill 2023 : What are the highlights and benefits to us? Finance Bill 2023: What are the highlights and benefits to us? [Part 2]](https://ancgroup.biz/wp-content/uploads/2023/05/FW1289389_PTJ03_24022023_PM-lpr-960x639.jpg)