What is the Tax Treatment of Benefits in Kind? - LATEST UPDATE : PUBLIC RULING NO. 11/2019

PUBLIC RULING NO. 11/2019 : Benefits in Kind

The objective of PUBLIC RULING NO. 11/2019 : Benefits in Kind is to explain –

a) The tax treatment in relation to Benefits in Kind (BIK) received by an employee from his employer for exercising an employment, and

b) The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee.

What is Benefits in Kind (BIK)?

BIK are benefits not convertible into money, even though they have monetary value. The benefit provided to the employee cannot be sold, assigned or exchange for cash either because of the employment contract or due to the nature of the benefit itself.

Is Benefits in Kind (BIK) considered as part of gross income?

Yes, according to Paragraph 13(1)(b) of the ITA provides that any amount equivalent to the BIK provided to the employee by/on behalf of his employer to be personally enjoyed by that employee considered as part of the employment gross income.

How to ascertain the value of BIK?

In accordance to subsection 32(1) of the ITA provides that the value of BIK to be taken as gross income from an employment of an employee is an amount which is just and reasonable in the circumstances. Two methods may be used to determine the value of BIK provided to the employee by the employer.

Formula Method:

Under this method, each benefit provided to the employee is ascertained by using the formula below:

Cost of the asset that is provided as benefit or amenity / Prescribed average life span of the asset = Annual Value of the benefit

Here, cost means the actual cost incurred by the employer

Example of Prescribed Average Life Span (Years)

| ASSETS | PRESCRIBED AVERAGE LIFE SPAN (YEARS) |

| 1. Motorcar |

8 |

| 2. Furniture and Fittings

a) Curtains and carpets

b) Furniture, sewing machine

c) Air conditioner

d) Refrigerator

|

5 15 8 10 |

| 3. Kitchen equipment (i.e. crockery, rice cooker, electric kettle, toaster, coffee maker, gas cooker, cooker hood, oven, dish washer, washing machine, dryer, food processor etc.) |

6 |

| 4. Entertainment and recreation:

a) Piano

b) Organ

c) TV, video recorder, CD/DVD player, stereo set

d) Swimming pool (detachable), sauna

|

20 10 7 15 |

| 5. Miscellaneous |

5 |

**The value of BIK based on the formula method provided to the employee by the employer can be abated if the BIK is –

a) Provided for less than a year, or/and

b) Shared with another employee, or/and

c) Used for purpose of the business of the employer.

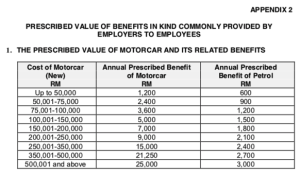

Prescribed value method:

As a concession, the prescribed value method can be used as an alternative to determine the value of the BIK provided by the employer to his employee.

The schedules for the prescribed values of the benefits commonly provided to the employee are as in Appendix 2.

Example of BIK applicable to Prescribed Value:

Benefits in kind on Motor Vehicle:

A m

otor vehicle which is provided to the employee and is regarded to be used privately if:

otor vehicle which is provided to the employee and is regarded to be used privately if:

• It is kept at the employee’s home where the motor vehicle can be used by the employee or his family at any time.

If the Motor Vehicle > 5 years old

: Annual value of BIK in respect of motorcar can be reduced to half.

: Value of BIK in respect of petrol remains unchanged.

Reconditioned Motorcar Imported from Overseas

where motorcar is imported from overseas, the first registration date in Malaysia, will be deemed to be the first year.

Under the MFRS 116, an item of property, plant and equipment that qualifies for recognition as an asset shall be measured at its cost.

To take note :

(divide by number of months the motorcar is in use)

– If free petrol is given, tax at Prescribe value or Actual spent ( exemption of RM6000 under 13(1)(a)

Benefits in kind on other benefits:

|

Amount Monthly (RM) |

Amount Annually (RM) |

|

| Gardener |

300 |

3,600 |

| Household Servant |

400 |

4,800 |

| Driver |

600 |

7,200 |

| Furniture

– Semi Furnished

– Semi Furnished (with air conditioner/carpets/curtains)

– Fully Furnished

|

70 140

280 |

840 1,680

3,360 |

| Service charges and other bills such as water and electricity |

Based on amount expended |

**The value of BIK based on the prescribed value method provided to the employee by the employer can be abated if the BIK is –

a) Provided for less than a year, or/and

b) Shared with another employee

Under the prescribed value method, there is no abatement for business usage on the BIK provided to the employee.

What is the tax treatment of Benefit in Kind (BIK)?

All Benefits in Kind received by an employee are taxable. However, there will be some tax exemptions on certain types of BIK.

Example of tax exemption on BIK received by employee:

FULL EXEMPTION:

– Dental Benefit

– Child-care benefit

(Child care centres provided by employers to their employees’ children)

– Food and drink provided free of charge- Free transportation between pick-up points or home and the place of work

(To and From)

– Group insurance premium

(Cover workers in the event of an accident)

– Local Leave passage

(Not more than 3 times in one calendar year)

– Discounted price for consumable business products

(If it is not convertible into money +Benefit of the Employee + Provided to employees as a whole)

– Discounted services provided by employer

– Benefits and monthly bills for fixed line telephone, mobile phone, pager, PDA and subscription of broadband

(Registered under the employers name, exempted up to 1 unit for each asset category)

– Modern medicine, traditional medicine and maternity

– Entrance Fee for Corporate membership (Owned by employer)

(If it is annual subscription fee is fully taxable)

PARTIAL EXEMPTION

– Oversea leave passage

(Not more than once in any calendar year, exemption up to RM3,000)

– Discounted price for consumable business products

(The value of the discount on goods will be exempted up to a maximum of RM1,000)

How to differentiate between BIK and Perquisite?

Perquisite is convertible into money (can be sold) | BIK is not convertible into money (cannot be sold)

Assets given free to employee (employee can sell if for cash) = Perquisite

Assets (under Company’s Book – Fixed Asset) provided to employee (ownership not transferred = BIK)

Golf Membership registered under individual = Company pay for the individual = Perquisite

Golf Membership registered under Company (ownership under Company) = Enjoy = BIK

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.