-

Who are agents, dealers or distributors in a business supply chain?

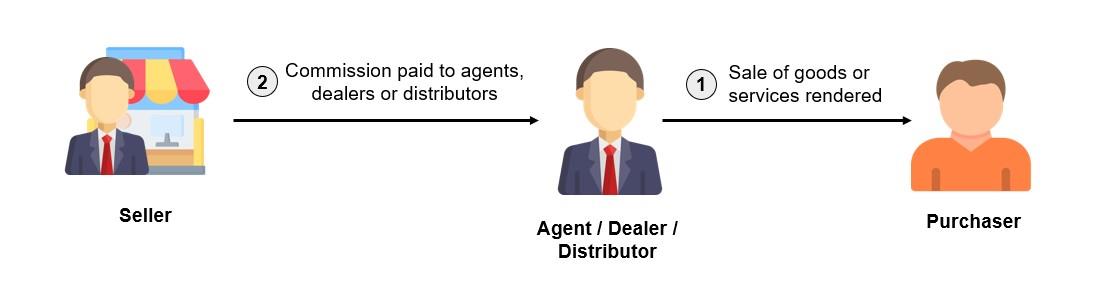

The use of an agent, dealer or distributor are commonly seen in a business supply chain. An agent, dealer or distributor (i.e., a third party / intermediary) will earn commission on the sale of products or provision of services to customers.

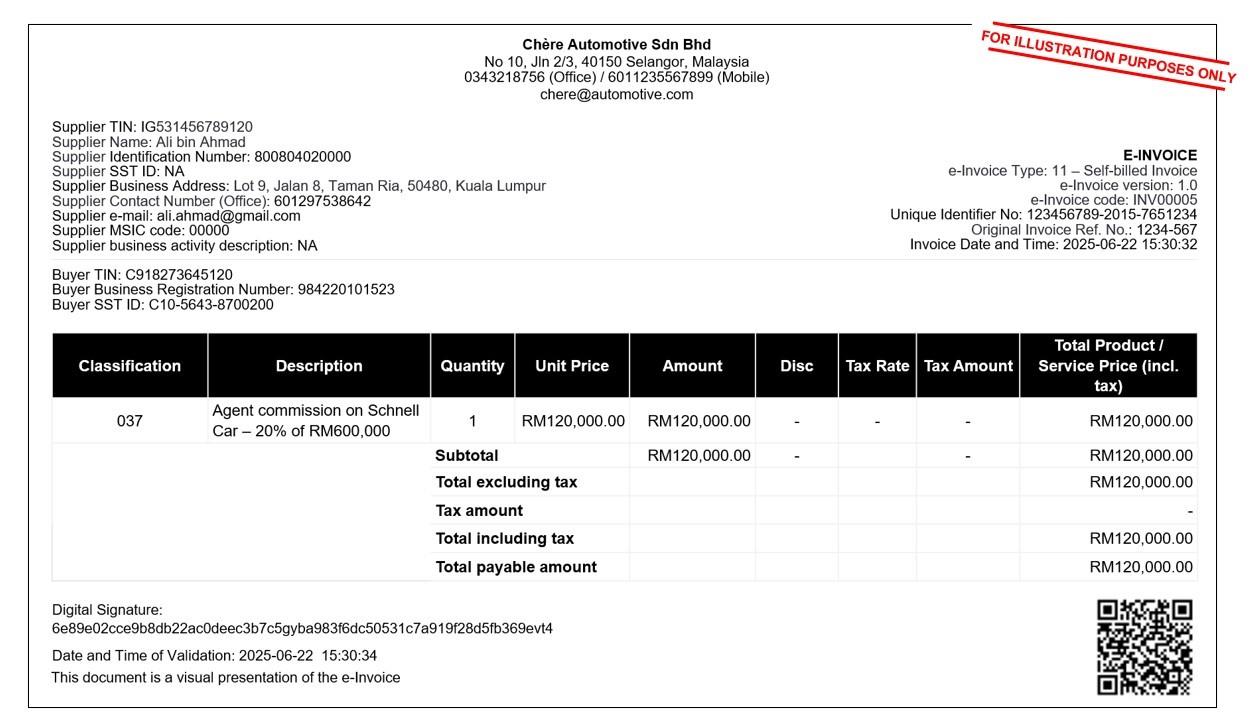

Figure 1.1 General overview of a business involving agent, dealer or distributor

Issuance of e-Invoice from Seller to Purchaser

-

What is the e-Invoice process when goods or services are purchased through an agent, dealer, or distributor?

-

- The seller must issue an e-Invoice to the purchaser to record the transaction.

- If the purchaser does not request an e-Invoice, the seller issues a regular receipt. At the end of the month, the seller must consolidate these receipts into an e-Invoice within seven calendar days for proof of income.

- The e-Invoice issuance process is detailed under Sections 3.5 and 3.6 of the e-Invoice Guideline.

-

Who assumes the roles of supplier and buyer in this scenario?

- Supplier: The Seller

- Buyer: The Purchaser

Issuance of Self-Billed e-Invoice from Seller to Agent, Dealer, or Distributor

-

What happens when an agent, dealer, or distributor earns a commission or incentive from the seller?

- The seller is required to issue a self-billed e-Invoice to document the payment or incentive provided to the agent, dealer, or distributor. This is in compliance with Section 83A of the Income Tax Act 1967.

- The e-Invoice issuance process is detailed under Sections 2.3 and 2.4 of the e-Invoice Guideline.

-

Who assumes the roles of supplier and buyer in a self-billed e-Invoice scenario?

-

- Supplier: The Agent, Dealer, or Distributor

- Buyer: The Seller (who issues the self-billed e-Invoice as proof of expense)