-

What is an e-commerce transaction?

An e-commerce transaction involves the sale or purchase of goods or services conducted over networks using methods specifically designed for receiving or placing orders. While orders are placed online, payment and delivery may not necessarily occur online.

-

Who is a foreign supplier in cross-border transactions

Foreign supplier refers to any supplier operating outside of Malaysia / not established in Malaysia, including non-Malaysian individual. Conversely, foreign buyer refers to any foreign person whom acquires goods and/or services from Malaysia.

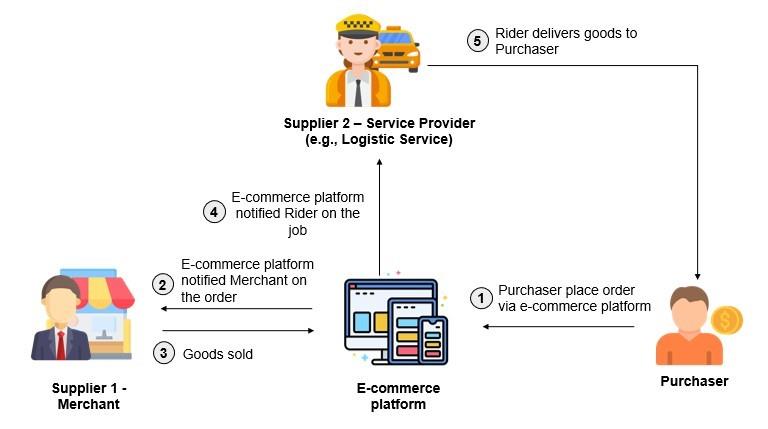

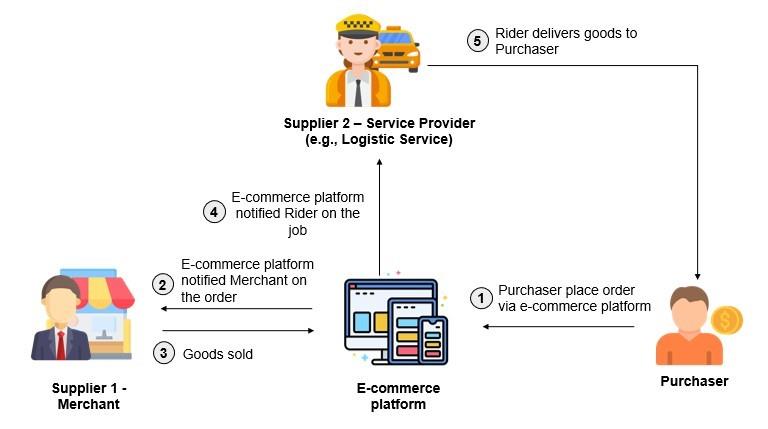

Figure 1.1 – General overview of an e-commerce transaction

Issuance of e-Invoice from e-commerce platform provider to Purchaser

-

How do e-commerce platform providers currently document transactions?

Currently, the platform providers issue an invoice, bill, or receipt to the purchaser to record transactions, such as the sale of goods or services conducted through their platform.

-

What changes with the implementation of e-Invoice for e-commerce platform providers?

Upon implementation of e-Invoice, the platform providers are responsible to assume the role of Supplier in facilitating the issuance of:

i. E-Invoice (upon Purchaser’s request); or

ii. Receipt (if Purchaser does not request for e-Invoice)

to the Purchaser for the transaction.

-

What are the roles of the parties in e-Invoice issuance to purchasers?

-

- Supplier: E-commerce platform provider

- Buyer: Purchase

-

What happens if the purchaser does not request an e-Invoice?

The platform providers may aggregate transactions without an e-Invoice request into a monthly consolidated e-Invoice, except for activities mentioned in specific guidelines, and submit it to IRBM within seven calendar days after the month-end.

-

Are merchants or service providers required to issue an e-Invoice?

No, merchants and service providers are not required to issue an e-Invoice or receipt for goods sold or services performed.

Issuance of Self-Billed e-Invoice by the e-commerce platform provider to Merchant and/or Service Provider

-

What happens after a transaction concludes on the e-commerce platform?

Merchants and service providers become eligible to receive payment for goods or services rendered.

-

How are self-billed e-Invoices handled after implementation?

E-commerce platform providers must issue self-billed e-Invoices to merchants or service providers for all concluded transactions. This is required for tax compliance and does not alter the commercial liability of the transaction.

-

What are the roles of the parties in this self-billed e-Invoice issuance?

-

- Supplier: Merchant or service provider

- Buyer: E-commerce platform provider (acting as the supplier for self-billed e-Invoices).

-

Can e-commerce platform providers submit self-billed e-Invoices periodically?

Yes, they can issue and submit self-billed e-Invoices for validation according to their existing statement issuance frequency (e.g., daily, weekly, or monthly).

Issuance of e-Invoice for Platform Charges to Merchants and Service Providers

-

How are platform usage charges documented?

E-commerce platform providers generally charge merchants or service providers for using their platform.

-

What is required after e-Invoice implementation for platform charges?

E-commerce platform providers must issue e-Invoices to merchants or service providers for platform usage charge

-

What are the roles of the parties for platform usage for e-Invoices?

- Supplier: E-commerce platform provider

- Buyer: Merchant or service provider

-

Is there a way to better understand the mechanism, implementation and transactions of e-commerce for e-Invoice?

Yes, you can gain further insights into the e-Invoice mechanism and workflow by referring to the official guidelines published by the Inland Revenue Board of Malaysia (IRBM).

You may also consider attending e-Invoice training courses for detailed guidance.

For more information or to register, please visit the contact link below: ANCGroup_E-Invoice Courses Contact.

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.