e-Invoicing 2024: How to Handle Reimbursements and Disbursements?

e-Invoicing 2024: How to Handle Reimbursements and Disbursements?

-

What is the difference between disbursements and reimbursements in e-Invoicing?

- Reimbursements refer to out-of-pocket expenses incurred by the payee during the sale of goods or provision of services, which are later reimbursed by the payer (buyer). Common examples include airfare, travel, and accommodation costs.

- Disbursements are expenses paid by the payee on behalf of the payer (buyer) to third parties in connection with services or goods, such as payments made to suppliers or service providers.

-

How should reimbursements and disbursements be reflected in e-Invoices?

- Reimbursements, the Supplier generally includes the reimbursed amount in the invoice, which will be paid by the buyer.

- Disbursements, the Supplier makes payments on behalf of the buyer and later recovers these amounts through separate invoicing. The disbursements should be listed as separate line items in the e-Invoice, along with the goods or services rendered.

-

Can suppliers consolidate disbursements or reimbursements in a single e-Invoice?

No, suppliers must issue separate e-Invoices for reimbursements and disbursements in line with the transaction type.

For example, disbursements will be included as separate line items, such as the service charge and the reimbursement cost. In some cases, suppliers can issue an e-Invoice for services provided and a payment proof for disbursements made on behalf of the buyer. -

Any examples of reimbursement or disbursement transactions in e-Invoicing

The following terminologies have been adopted to ease the understanding of the scenario discussion in Section A and B:

-> Supplier 1 represents the First Supplier; and

-> Supplier 2 represnets the third party / intermediary

-

-

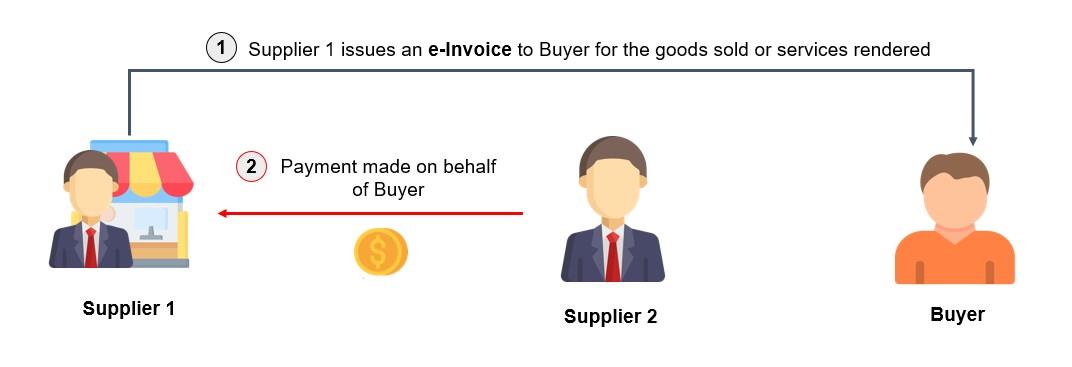

Section A – Scenario where Supplier 1 issues e-Invoice to Buyer

Supplier 1 issues an e-Invoice directly to Buyer for the goods sold or services rendered to Buyer. Subsequently, Supplier 2 made payment to Supplier 1 to settle the said e-Invoice issued to Buyer. In accordance with the arrangement agreed between Supplier 2 and Buyer.

Accordingly, Supplier 2 will issue an e-Invoice to Buyer for the goods sold or service rendered by Supplier 2.

As Supplier 1 has issued an e-Invoice to Buyer, the same should not be included in the e-Invoice issued by Supplier 2 to Buyer.

The steps involved for the issuance of e-Invoice for the scenario above are as follows:

Step 1:

Supplier 2 entered into an agreement with Buyer for supply of goods or provision of services. As part of the arrangement, Supplier 2 will make payment on behalf of Buyer to settle any expenses incurred during the contract period.Step 2:

Upon concluding a sale or transaction, Supplier 1 will issue an e-Invoice directly to the Buyer as per the required fields as outlined in Appendices 1 and 2 of e-Invoice Guideline and submit it to IRBM for validation.The process of issuing an e-Invoice is similar to the e-Invoice workflow as discussed in Section 2.3 (e-Invoice model via MyInvois Portal) and Section 2.4 (e-Invoice model via API) of e-Invoice Guideline.

Step 3:

Supplier 2 will make payment on behalf of Buyer to Supplier 1 to settle the outstanding amount. Supplier 1 will issue payment proof to Supplier 2 for the settlement.Step 4:

Supplier 2 will issue an e-Invoice to the Buyer for the goods supplied or services rendered by Supplier 2 to Buyer (the process of issuing e-Invoice is similar to Step 2 above). Supplier 2 should neither include the payment made on behalf of Buyer in Supplier 2’s e-Invoice nor issue an additional e-Invoice for it.Supplier 2 provides payment proof to the Buyer to recover the payment made to Supplier 1 on behalf of the Buyer.

-

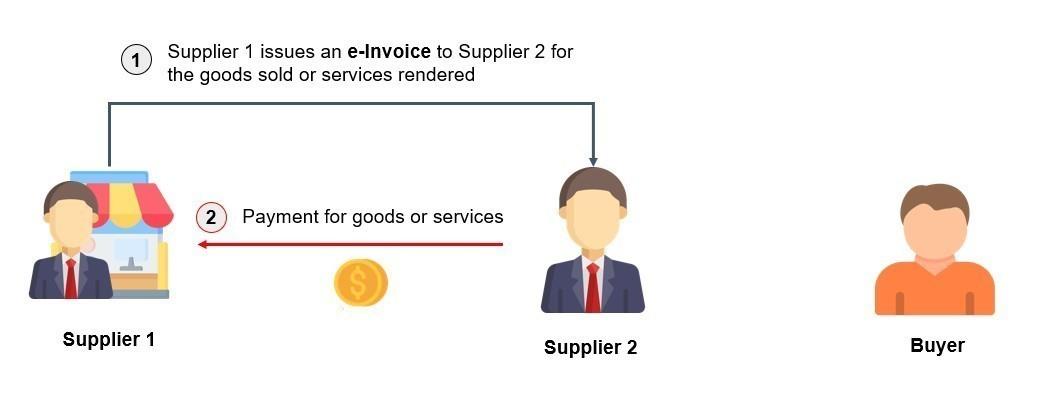

Section B – Scenario where Supplier 1 issues e-Invoice to Supplier 2

Supplier 1 issues an e-Invoice to Supplier 2 for the goods sold or services rendered intended for Buyer. Supplier 2 makes payment to Supplier 1, according to the arrangement agreed between Supplier 2 and Buyer.

Accordingly, Supplier 2 will issue a separate e-Invoice to Buyer to record the amount incurred on behalf of Buyer alongside with the goods sold or service rendered by Supplier 2, in which these will be presented as separate line items in the e-Invoice (i.e., one line for service fee charges and another line for disbursement / reimbursement).

The steps involved for the issuance of e-Invoice for the scenario above are as follows:

Step 1:

Supplier 2 entered into an agreement with Buyer for supply of goods or provision of services. As part of the arrangement, Supplier 2 will make payment on behalf of Buyer to settle any expenses incurred during the contract period.Step 2:

Upon concluding a sale or transaction, Supplier 1 will issue an e-Invoice to Supplier 2 as per the required fields as outlined in Appendices 1 and 2 of e-Invoice Guideline and submit it to IRBM for validation.The process of issuing an e-Invoice is similar to the e-Invoice workflow as discussed in Section 2.3 (e-Invoice model via MyInvois Portal) and Section 2.4 (e-Invoice model via API) of e-Invoice Guideline.

Step 3:

Supplier 2 will make payment to Supplier 1. Supplier 1 will issue payment proof to Supplier 2 for the settlement.Step 4:

Supplier 2 will issue an e-Invoice to the Buyer (similar as per Step 2 above) to record the amount incurred on behalf of Buyer (e.g., disbursement / reimbursement) alongside with the goods sold or service rendered by Supplier 2, which will be presented as separate line items in the e-Invoice.

-

-

Is there a way to better understand the mechanism, implementation, Reimbursement and Disbursement for e-Invoice?

Yes, you can gain further insights into the e-Invoice mechanism and workflow by referring to the official guidelines published by the Inland Revenue Board of Malaysia (IRBM).

-

-

- Download e-Invoice Guideline Version 4.0 (published on 04 October 2024)

- Download e-Invoice Specific Guideline Version 3.1 (published on 04 October 2024)

- View e-Invoice Illustration Guide (Updated on 11 September 2024)

-

You may also consider attending e-Invoice training courses for detailed guidance.

For more information or to register, please visit the contact link below: ANCGroup_E-Invoice Courses Contact.

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.