When to issue e-Invoice: Latest and Essential Guidelines 2024

When to issue e-Invocie: Latest and Essential Guidelines 2024

-

When to issue e-Invoice?

An e-Invoice must be issued in two key scenarios:

Proof of Income: This document is required when a sale or transaction takes place, as it serves to recognize the income of taxpayers.

Proof of Expense: This document is necessary for purchases or other expenses incurred by taxpayers, including returns and discounts. It also serves to correct or adjust previously documented income receipts. In some cases, such as foreign transactions, taxpayers must issue a self-billed e-Invoice.For example, if a taxpayer acquires goods or services from a foreign supplier who does not use Malaysia’s MyInvois System, they must issue a self-billed e-Invoice to document the expense.

-

Are there any activities that specifically require e-Invoice to be issued instead of consolidated e-Invoice?

Yes, certain activities or transactions require the issuance of an individual e-Invoice for each transaction. In these cases, consolidated e-Invoices are not allowed. Taxpayers involved in these activities must obtain the buyer’s details and issue a separate e-Invoice for each transaction. The industries affected are specified in a table below:

No Industry Types of Activities 1 Automotive Sale of any motor vehicle 2 Aviation Sale of flight ticket and private charter 3 Luxury Goods and Jewelry Details will be released in due course Taxpayers are allowed to issue consolidated e-Invoice until further notice

4 Construction Construction contractor undertaking construction contract, as defined in the Income Tax (Construction Contracts) Regulations 2007 5 Wholesalers and Retailers of Construction Materials Sale of construction materials, regardless of volume sold. Construction material as specified under the Fourth Schedule of Lembaga Pembangunan Industri Pembinaan Malaysia Act 1994

6 Licensed Betting and Gaming Pay-out to winners for all betting and gaming activities 7 Payment to Agents / Dealers / Distributors Payments made to agents, dealers or distributors. -

What types of e-Invoices need to be submitted and validated?

There are specific types of e-Invoices that must be submitted and validated as per the guidelines. These are outlined in a table below:

Code Document Type Description 01 Invoice * Describes and records sales transaction. 02 Credit Note Correct errors, apply discounts or returns to reduce value of original invoice. 03 Debit Note Indicate additional charges on previously issued invoice. 04 Refund Note Refund of sales’ payment. 11 Self-Billed Invoice * Describes and records supplier (self-billed) transaction / expense 12 Self-Billed Credit Note Correct errors, apply discounts or returns to reduce value of supplier invoice. 13 Self-Billed Debit Note indicate additional charges on previously issued supplier invoice. 14 Self-Billed Refund Note Refund of payment to supplier. * E-Invoice and Self Billed e-Invoice are further expanded to include consolidated e-invoice and consolidated self-billed e-Invoice, which is to be submitted by 7th of the subsequent month

-

What are the methods available for businesses to submit their e-Invoices?

Businesses have several options for submitting their e-Invoices, including:

- Peppol Network

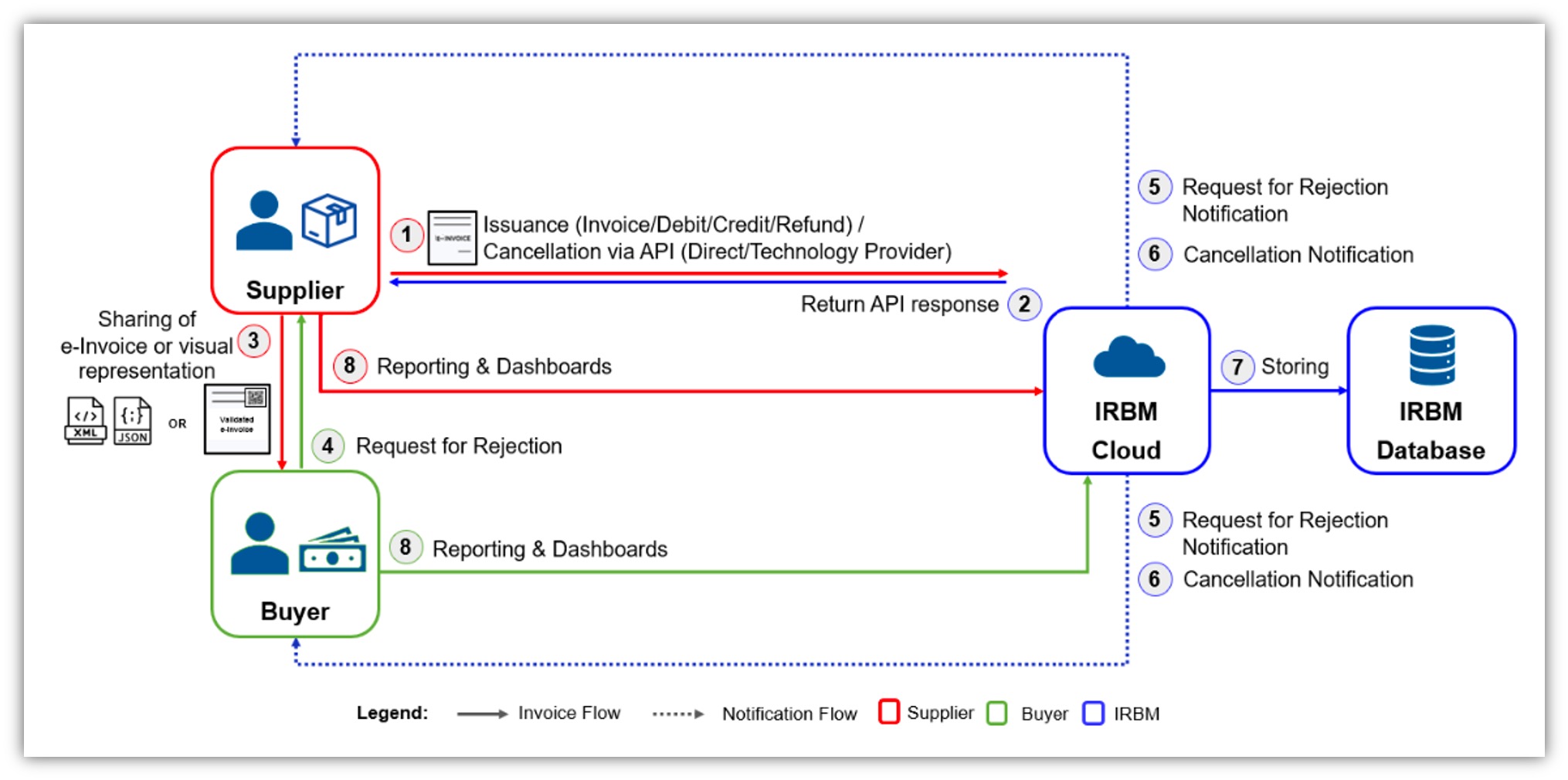

- Application Programming Interface (API) (refer to Image 1.1)

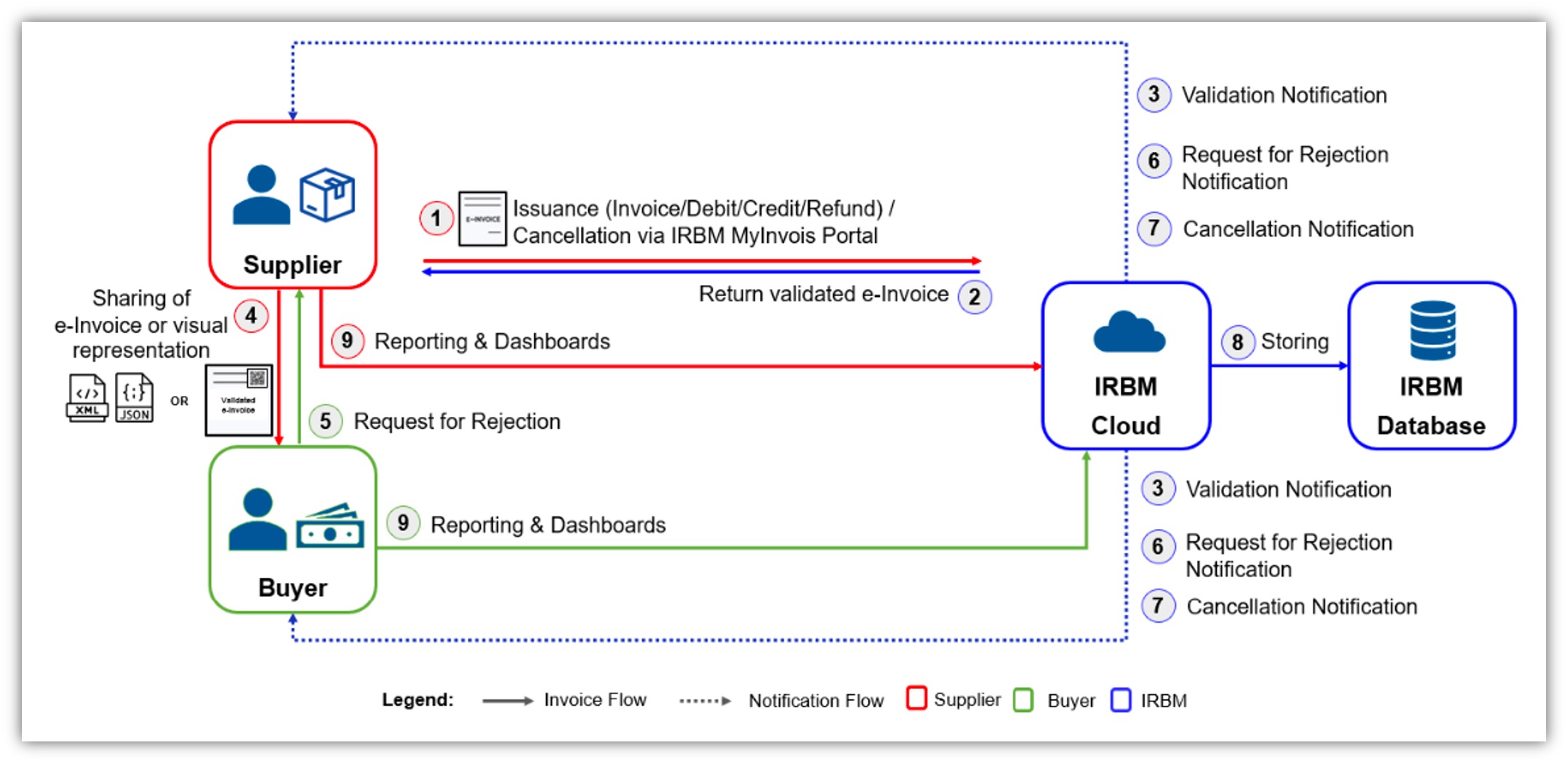

- MyInvois Portal (refer to image I.2)

A flowchart illustrating below the e-Invoice submission process is provided to guide businesses through the submission steps.

Image 1.1

Image 1.2

- Is there a way to better understand the mechanism, implementation, Tax Identification Number (TIN) for e-Invoice?

Yes, you can gain further insights into the e-Invoice mechanism and workflow by referring to the official guidelines published by the Inland Revenue Board of Malaysia (IRBM).

-

-

- Download e-Invoice Guideline Version 4.0 (published on 04 October 2024)

- Download e-Invoice Specific Guideline Version 3.1 (published on 04 October 2024)

- View e-Invoice Illustration Guide (Updated on 11 September 2024)

-

You may also consider attending e-Invoice training courses for detailed guidance.

For more information or to register, please visit the contact link below: ANCGroup_E-Invoice Courses Contact.

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.