November 25, 2024

November 25, 2024

Categories

e-Invoicing: Why issuing self-billed e-Invoice matters now? What is self-billed e-Invoices? When a sale or […]

Do you like it?

November 25, 2024

November 25, 2024

Categories

Ultimate Guide to Mandatory and Optional Fields for e-Invoice 2024 What are the fields required […]

Do you like it?

November 20, 2024

November 20, 2024

Categories

When to issue e-Invocie: Latest and Essential Guidelines 2024 When to issue e-Invoice? An e-Invoice […]

Do you like it?

October 18, 2024

October 18, 2024

Categories

Do you like it?

October 18, 2024

October 18, 2024

Categories

Do you like it?

October 4, 2024

October 4, 2024

Categories

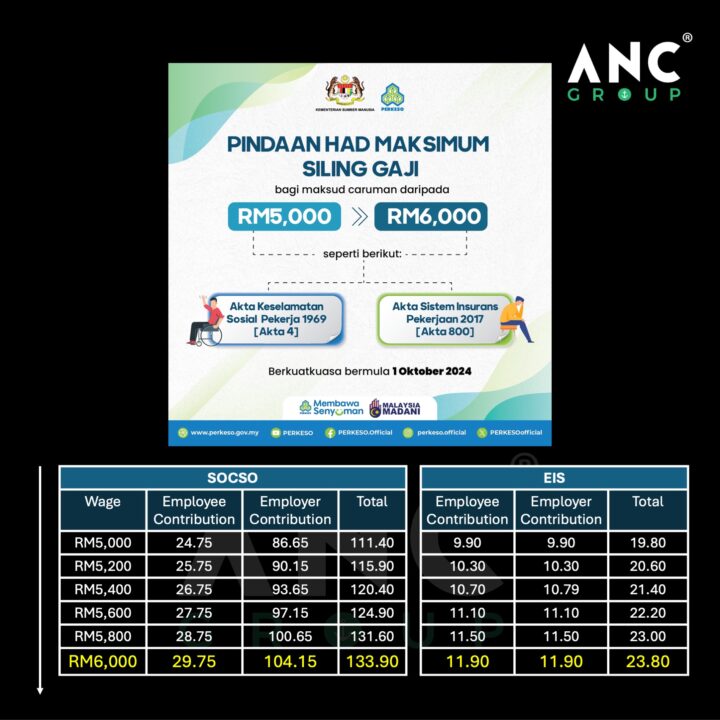

⚓️ SOCSO 社險 和 EIS 就业保险 上限额正式从 原有的 RM5,000 提高至 RM6,000。 . 这项提案终于在2024年10月1日,正式生效。这表示2024年10月的薪金开始,将会缴纳更多的 SOCSO 社险 […]

Do you like it?

October 4, 2024

October 4, 2024

Categories

With effect from 1 October 2024, SOCSO and EIS Contribution ceiling has been increased from […]

Do you like it?

October 4, 2024

October 4, 2024

Categories

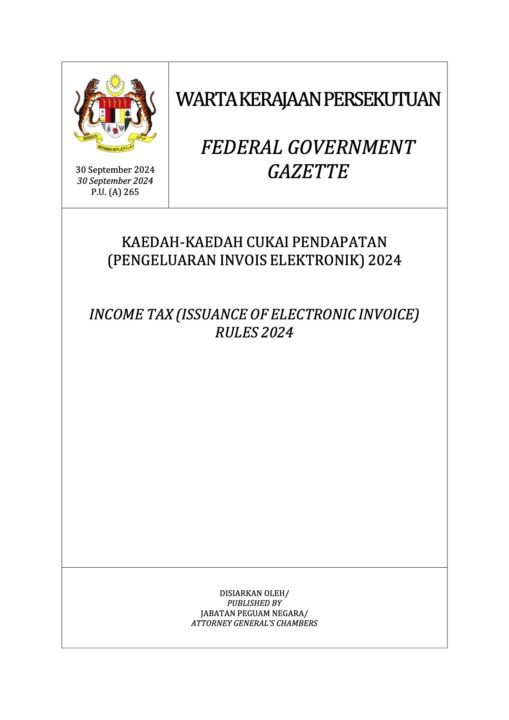

⚓ 2024年9月30日,马来西亚政府正式发布《所得税(电子发票)规则 2024》,为电子发票的发行提供了全面的指南。 . 主要亮点包括: . 1️⃣ 强制性电子发票的门槛将基于2022年财务报表中的营业额确定。 . 2️⃣ 电子发票规则不适用于: – 外国外交机构 – 不从事商业活动的个人 […]

Do you like it?

October 4, 2024

October 4, 2024

Categories

⚓ On September 30, 2024, the Malaysian government officially gazetted the Income Tax (Issuance of […]

Do you like it?

September 23, 2023

September 23, 2023

Categories

PUBLIC RULING NO. 11/2019 : Benefits in Kind The objective of PUBLIC RULING NO. 11/2019 […]

Do you like it?

September 23, 2023

September 23, 2023

Categories

PUBLIC RULING NO. 11/2016 : TAX BORNE BY EMPLOYERS The objective of PUBLIC RULING NO […]

Do you like it?

September 23, 2023

September 23, 2023

Categories

PUBLIC RULING NO. 9/2016 : Gratuity The objective of this PUBLIC RULING NO. 9/2016 is […]

Do you like it?

May 26, 2023

May 26, 2023

Categories

PUBLIC RULING NO. 5/2019 : Perquisites From Employment The objective of this PUBLIC RULING NO. […]

Do you like it?

May 25, 2023

May 25, 2023

Categories

Finance Bill 2023 : What are the highlights and benefits to us? This TaxLetter is […]

Do you like it?

May 8, 2023

May 8, 2023

Categories

Revised Budget 2023: What are the highlights and benefits to us? Themed Developing A Civil […]

Do you like it?

March 29, 2023

March 29, 2023

Categories

Public Ruling No. 6/2022 – Accelerated Capital Allowance The objective of Public Ruling No. 6/2022 […]

Do you like it?

March 29, 2023

March 29, 2023

Categories

Public Ruling No. 7/2022 : Venture Capital Tax Incentives The objective of Public Ruling No. […]

Do you like it?

March 29, 2023

March 29, 2023

Categories

Taxation of Resident Individual Part II – Computation of Total Income and Chargeable Income This Public […]

Do you like it?

March 13, 2023

March 13, 2023

Categories

Tax Treatment on Real Property Gains Tax (“RPGT”) The Real Property Gains Tax Guidelines 2023 […]

Do you like it?

March 13, 2023

March 13, 2023

Categories

Tax Treatment in Relation to Foreign Source Income Received in Malaysia (Amendment) The contents of […]

Do you like it?

![FW1289389 PTJ03 24022023 PM lpr – Finance Bill 2023 : What are the highlights and benefits to us? Finance Bill 2023: What are the highlights and benefits to us? [Part 2]](https://ancgroup.biz/wp-content/uploads/2023/05/FW1289389_PTJ03_24022023_PM-lpr-960x639.jpg)