SSM NOTICE: IMPLEMENTATION OF NEW 12 DIGIT REGISTRATION NUMBER

Companies Commission of Malaysia (SSM) had officially announced that starting from 11 October 2019, all the business entities will be using a NEW FORMAT OF REGISTRATION NUMBER containing 12 digit characters for company, business and Limited Liability Partnership.

Obtaining Regsitration Number Format

You may obtain your NEW REGISTRATION NUMBER FORMAT from SSM‘s Portal as below for free from 11th October 2019.

(a) SSM e-Search; or

(b) SSM e-info; or

(c) MyData SSM; or

(d) Consult from your company secretary

Existing Company

For those business entities registered before 11th October 2019, you may still use your existing registration number on your official letters, invoices, signboards and other printed documents until further official notice issued by SSM on the official date to replace your existing registration number with the new registration format number.

However, business entities are encouraged to use the New Registration Number Format from 11th October 2019 onward. As this new registration number format will appear in all SSM’s corporate information supplied to customers and will replace the existing registration number. Please take note that throughout the transition period, the existing registration number may be displayed along with the new format as below:

| Current Format | New Format |

|---|---|

| Company Name: AMS Setia Jaya Sdn Bhd | Company Name: AMS Setia Jaya Sdn. Bhd. |

| Registration No.: 1312525-A | Registration No.: 20191000005 (1312525-A) |

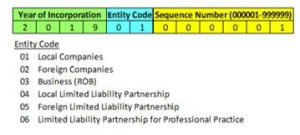

The new registration number format consists of a 12 digit number comprising of:

Federal Gazette on Capital Allowance incurred on Development of Customised Software

Effective Year of Assessment (YA) 2018, expenditure incurred on the development of customised software comprising of consultation fee, licensing fee and incidental fee related to software development incurred:

1.By a resident in Malaysia in the basis period of 2018 onwards; and

2.Use for business

Shall qualifies capital allowance as follows:-

| Initial Allowance | Annual Allowance |

| 20% | 20% |

These rules shall not apply to a person who has incurred development cost where that basis period the person is eligible and has claimed:-

(a)Any incentive under Promotion of Investment Act 1986;

(b)Any deduction under s.33 of Income Tax Act (ITA);

(c)Any deduction under s.34 of ITA;

(d)Reinvestment Allowance under Schedule 7A of the ITA;

(e)Investment allowance for Service Sector under Schedule 7B of the ITA;

(f)Accelerated capital allowance under any rules made under s.154 of the ITA; or

(g)Tax exemption under s. 127(3)(b) or s.127(3A) of the ITA.

If you need our assistance, please contact us at admin@ancgroup.biz ; or drop us an enquiry via the enquiry form below.