Under the Malaysia Income Tax Act 1967, rental income is not always treated the same way. Depending on the level of services provided by a landlord, rental income may be taxed as either business income [s.4(a)] or investment income [s.4(d)]. This classification significantly impacts how expenses are deducted, whether capital allowance is available, and how rental losses are treated.

In this article, we break down the key rules from Public Ruling 12/2018 and the relevant provisions of the Income Tax Act, providing landlords and property investors with a clear understanding of Malaysia rental income tax.

According to Public Ruling (PR) 12/2018, rental income is taxed as business income under section 4(a) when the landlord provides comprehensive and active maintenance or support services. These services may be provided directly or through third parties. Passive rental collection does not qualify.

Eligible to claim capital allowance on qualifying assets.

All expenses incurred are deductible under s.33(1) without restriction.

Rental losses (where expenses exceed rental income) are treated as current year business losses, which can be carried forward.

Date of commencement is when the property is ready and available for letting.

Advertisement to secure the first tenant

Legal fees for initial tenancy agreement

Stamp duty, Quit rent

Assessment prior to commencement

Agent’s commission for securing the first tenant

Assessment and quit rent

Loan interest

Fire insurance premium

Supervision, rental collection, and legal expenses

Cost of obtaining a replacement tenant (not the first tenant)

Ordinary repair and maintenance costs

Security services, repainting, burglary insurance

Renewal of tenancy agreement

Advance rental is treated as gross business income in the year it becomes receivable. If

any amount is refunded, it will be deductible against gross income in the relevant year.

Rental income is classified under section 4(d) when the landlord does not provide active and comprehensive support or maintenance services.

Date of commencement is when the property is first rented out.

Rental losses cannot be carried forward; they are permanent losses.

Industrial building allowance (IBA) may still apply in certain cases.

Advertisement for the first tenant

Legal fees for the first tenancy agreement

Stamp duty, quit rent, and assessment prior to commencement

Agent’s commission for the first tenant

Assessment and quit rent

Loan interest

Fire insurance premium

Supervision and rental collection fees (including legal expenses)

Cost of obtaining or replacing tenants (excluding the first tenant)

Repairs and maintenance

Replacement of assets (replacement basis only; improvements are capital in nature)

Renewal of tenancy agreements

Note: Expenses incurred before the property is rented out are not deductible and must be adjusted proportionately.

Rental income is assessed on a receipt basis but taxable when it becomes receivable.

Advance rental is taxable in the year of receipt, even if refundable.

Case law (EK Sdn Bhd vs DGIR): Advance rent received for 10 years was fully taxed in the year of receipt, under section 27(3).

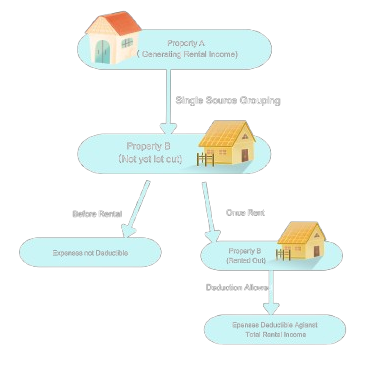

Landlords may group all real properties as a single source of income under s.4(a) or s.4(d), provided that each property has started generating rental income.

If a property has not started generating income, its expenses cannot be set off against other rental income.

Once it generates rental income:

s.4(a): Expenses are deductible for the full year, as long as other properties generated income at the beginning of the year.

s.4(d): Expenses are deductible only from the date the property is rented out.

Expenses remain deductible if the property is vacant due to:

Repairs or renovations

Lack of tenants (up to 2 years)

Legal injunction or official sanction

Other circumstances beyond the landlord’s control

Provided that the property is maintained in good condition and ready for letting.

s.4(a): If advance rental is taxed in a year, subsequent related expenses are deductible in the year incurred.

s.4(d): Expenses must be matched with the year the rental income was taxed in advance.

Security deposits are not taxable when received, unless converted to rental or forfeited.

Refund of deposit is not deductible, since it was not taxable upon receipt.

Where a loan is taken for business purposes to finance real property used for letting, interest expenses must be restricted under subsection 33(2). Loan interest incurred to finance rental property is deductible against rental income, but only to the extent allowed by the Income Tax Act.

Understanding the distinction between business income [s.4(a)] and investment income [s.4(d)] is crucial for landlords in Malaysia. The tax treatment affects whether you can carry forward rental losses, claim capital allowances, or deduct certain expenses.

By properly classifying your rental income under the Malaysia Income Tax Act 1967, landlords can ensure compliance while maximizing tax efficiency. Where rental arrangements are complex, engaging a professional tax advisor is strongly recommended.

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.

If you need professional tax advisory services regarding the Malaysia Income Tax Act 1967, our team is ready to assist you. Contact us here to discuss how we can support your business.

D-21.07, Menara Suezcap 1,

Gerbang Kerinchi Lestari,

No.2, Jalan Kerinchi ,

59200 Kuala Lumpur

© ANC Group