History and Background of 2% Withholding Tax

In accordance with Section 83A of the Income Tax Act 1967 (ITA), Every Company is required to prepare and provide a prescribed form (Form CP58) to its agents, dealers, or distributors pertaining to particulars of commission payments regardless of whether in monetary or in kind.

The Form must be furnished to agents, dealers, or distributors not later than 31 March of the following year. For instance, commission for the Year 2022, Form CP58 must be furnished to agents, dealers, or distributors by 31 March 2023.

Prior to the Year 2022, no withholding tax is applicable.

Effective Year 2022, a company that makes payments in monetary form to an agent, dealer, or distributor arising from sales, transactions, or schemes carried out by that agent, dealer, or distributor, is subjected to a 2% Withholding Tax.

Who is the Payer which is obliged to Deduct Withholding Tax ?

We understand that Section 83A specifies every Company, herein referred to as the “Payer” is obliged to provide Form CP58 to its agents, dealers, and distributors. The definition of “Company” herein refers to companies incorporated under the Companies Act 1965 or 2016.

Sole Proprietors, Partnerships, and Limited Liability Partnerships do not fall within the definition of Company, pursuant to Section 2 of the Income Tax Act 1967.

Who is the Payee which is obliged to be Deducted Withholding Tax ?

Pursuant to the Finance Act 2021, a new Section 107D was included. Section 107D explains that whenever there is a payment in monetary form paid to an agent, dealer, or distributor (Payee) at any time in a basis year, the payer shall upon paying or crediting such payments deduct therefrom a 2% Withholding Tax, within 30 days after paying or crediting such payments.

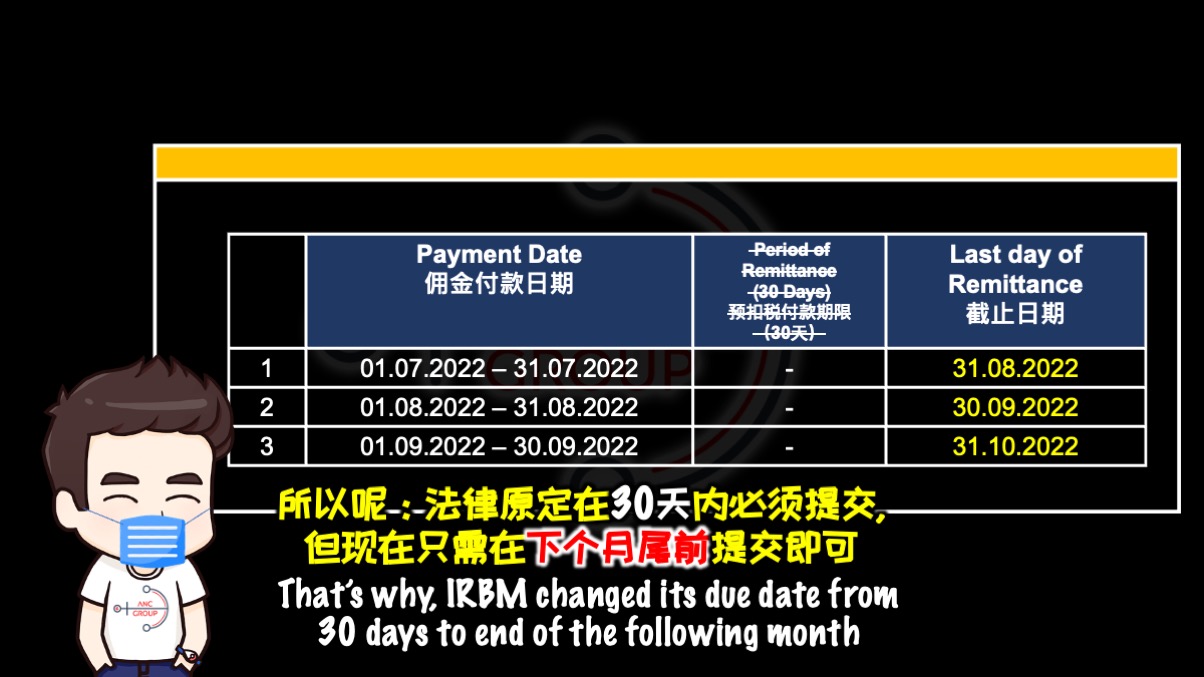

Effective July 2022, the Inland Revenue Board of Malaysia (IRBM) (tax agency or authority appointed by the Ministry of Finance Malaysia), the due date for remittance of Withholding Tax has been changed to the end of the following month instead of 30 days. For instance : The payment was made from 1 July 2022 to 31 July 2022, the due date to remit to IRBM is 31 August 2022.

Kindly refer to IRBM’s Media Release HERE.

Section 107D(6) further explains that agent, dealer, or distributor means any individual resident who is authorized by a company to act as its agent, dealer, or distributor.

Clearly, the agent, dealer, or distributor was not clearly defined, whether referring to any person under a contract for service or any similar arrangement. But, one thing worth noting here is the “Individual Resident”.

Individual herein refers to any natural person, that means if the payee is a:-

1. Company, Limited Liability Partnership or Partnership: Not subject to Withholding Tax;

2. Sole Proprietor: Owner subjected to Withholding Tax.

In addition, Resident refers to tax resident defined under Section 7(1), i.e. those who are in Malaysia for at least 182 days. Please do take note there are 4 circumstances in which a person can be a tax resident in Malaysia. 182 days is merely one of the scenarios and the person can be a Tax Resident even though he/she was in Malaysia for less than 182 days.

A resident here refers to any person regardless of whether he/she is a Malaysian Citizen or otherwise.

The threshold for Withholding Tax to be applicable and Case Study

Do take note that not all agents, dealers, or distributors will be subject to a 2% Withholding Tax.

In accordance with Section 107D(2) of the ITA, the Withholding Tax will only be applicable if the total sum of payments, whether in monetary form or otherwise, is received by that payee from the payer immediately preceding basis year is more than RM100,000.

Example 1

In 2021, Mr. A received a monetary commission from ANC-Property Agency amounted to RM80,000 and RM30,000 for incentive trips. Total RM110,000.

In 2022, Mr. A received a monetary commission from ANC-Property Agency amounted to RM50,000 and an RM20,000 incentive trip.

Tax Treatment: Since the sum received in 2021 is RM110,000, Mr. A is subjected to Withholding Tax in 2022. The amount subject to Withholding Tax is RM50,000 – the monetary payment only. The Withholding Tax amount is 2% x RM50,000 = RM1,000.

Example 2

In 2021, Mr. B received a monetary commission from ANC-Property Agency amounted to RM50,000.

In 2022, Mr. A received a monetary commission from ANC-Property Agency amounted to RM110,000 and an RM20,000 incentive trip.

Tax Treatment: Since the sum received in 2021 is RM50,000 (less than the RM100,000 threshold), Mr. B is not subjected to Withholding Tax in 2022.

Summary

Submission Form and Payment Instructions

Step 1 : Download and Complete the forms below:-

Form CP107D : HERE.

Appendix to Form CP107D (for more than 1 agent and a maximum of 20 agents: HERE.

Step 2 :

In general, there are only 3 branches throughout Malaysia that are handling the 2% Commission Withholding Tax:

- Kuala Lumpur Branch for Peninsular Malaysia

- Kuching, Sarawak Branch

- Kota Kinabalu, Sabah Branch

After deciding which branch you are dealing with, email the completed CP107D (PDF) and/or CP107D (Excel) to the following emails:-

- Kuala Lumpur Branch: pdkl-cp107d@hasil.gov.my

- Kuching, Sarawak Branch: pbkc-cp107d@hasil.gov.my

- Kota Kinabalu, Sabah Branch : pbkk-cp107d@hasil.gov.my

Step 3 :

Remittance of payment via post or payment counter at the abovementioned tax branch.

Effective July 2022, the Inland Revenue Board of Malaysia (IRBM), the due date for remittance of Withholding Tax has been changed from existing 30 days to the end of the following month. For instance:-

The payment was made from 1 July 2022 to 31 July 2022, due date to remit to IRBM is 31 August 2022.

Please take note, that as of the date of publication of this article, the proposed amendment has yet to be gazetted. IRBM announced such a change via Media Release. Payers who are worried are advised to follow the original due date which is 30 days from the payment or crediting date. We are expecting such changes to be taken into account in the Finance Bill/Act 2022.

Summary

Individual (Payee)’s Tax Case Study (CP500 and Withholding Tax)

Agents, Dealers, or Distributors are deemed to be deriving business income, therefore subject to tax installment under Form CP500, which is payable in 6 installments every year of assessment.

Will the Agents, Dealers or Distributors be taxed twice on the same income?

The income will only be taxed once when the individual submits their tax return later. They will not be taxed twice, but they will have to pay the tax in advance twice. CP500 was estimated based on the income the individual suppose to have while Withholding Tax is payable when the payer pays you.

To illustrate it better, let’s put a basis year to it.

IRBM issued a CP500 based on my estimated income for the Year 2022. The 6 installments are payable in March 2022, May 2022, July 2022, September 2022, November 2022, and January 2023.

It was estimated based on my income generated for the Year 2022.

Nonetheless, I have to pay tax in advance again for the same income for 2022, received in 2022, under 2% withholding Tax.

Although there is no double taxation, it will cause some cash flow or liquidity to me, as the taxpayer.

Example 3

Mr. C earned a commission income of RM110,000. After taking into account personal relief of RM9,000 and lifestyle relief of RM1,000, his chargeable income is RM100,000 in 2022. The total tax payable to the IRBM is RM10,700.

Mr C has paid CP500 of RM12,000 (RM2,000 per month) and additional RM2,200 (RM110,000 x 2%) to the IRBM.

The total Tax Refundable to Mr C is RM10,700 (Tax Payable) – RM12,000 (CP500) – RM2,200 (2% Withholding Tax) = (RM3,500).

Implications of Company / Payer Fails to Deduct Withholding Tax

Implication 1

Where the Company or Payer fails to deduct Withholding Tax in compliance with the requirement mentioned above, an increased sum (penalty) of 10% will be imposed [s.107D(3) of Income Tax Act 1067].

Implication 2

Pursuant to Section 39(r), tax deduction of the commission/expenditure will not be granted.

Frequently Asked Questions (FAQ) for 2% Withholding Tax Commission

Question 1 :

As a Company, when we make payments to our payees, we may not know whether the payee is a sole proprietor/enterprise; or a partnership. What should we do?

You would have to check with them as soon as possible.

Question 2 :

When I declare the agent’s withholding tax, I do not know his/her tax reference number. Where can I check?

If you have their Identification Number, you can check from: HERE.

Question 3 :

I noticed that the agent has yet to register as a taxpayer with IRBM. What should I do?

Get them to register themselves as soon as possible: HERE.

Question 4 :

Where can I get more information from ANC Group?

You can get more information at our:-

- Social Media Page: https://www.facebook.com/ANCGroupConsultants/

- BIP (Educational Videos – Exclusively for Clients and Subscribers): https://bip.ancgroup.biz/