Download PDF version : HERE

PEMERKASA Stimulus Package

On 17 March 2021, the Malaysian Government unveiled a new economic recovery program, named Program Strategik Memperkasa Rakyat dan Ekonomi (Strategic Programmes to Empower the People and Economy) or PEMERKASA. The stimulus package is worth RM20 billion.

The key highlights of the key initiatives are as follows:-

|

Description |

|

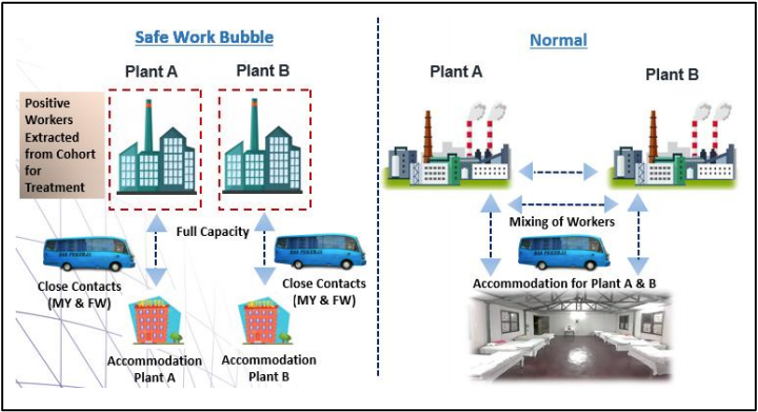

Additional Tax Deduction on Rental incurred on Hostel / Premise Provided to Manufacturing or Service Companies related to Manufacturing Industries It is proposed that additional tax deduction of up to RM50,000, will be given to companies operating in the manufacturing sector and service sector related to the manufacturing sector. The qualifying conditions include:- a)Companies registered with Ministry of International Trade and Industry (MITI); and b)Compliance with Safe @ Work Audit requirements. Safe @ Work is a Government initiative promoting enhanced public health measures to empower employers to be accountable for containing the pandemic among their workers. It contains SOPs detailing preventive measures and case management through the creation of Safe Work Bubble. Safe Work Bubble is an isolation of workers into group in hostels and factories. The purpose of this Safe Work Bubble is to allow close contact workers to continue working in the factory even if test results have not been obtained. This is to allow business continuity even when there are positive cases at the workplace. Companies can submit their registration through MITI COVID-19 Intelligence Management System (CIMS) starting from 1 April 2021.

|

|

Further Tax Deduction on Expenses incurred on COVID-19 Screening For Employees It was proposed that an additional tax deduction will be given to employers who incurred expenses on COVID-19 screening tests for its employees. Effective for expenses incurred until 31 December 2021. |

|

Deferment of Tax Instalment Payment for Tourism Sector and Affected Sectors It was proposed that companies in the tourism industry, spas and cinemas will be given deferment for payment of their monthly tax estimate instalments for the period of 1 April 2021 to 31 December 2021. Application must be submitted to the Inland Revenue Board of Malaysia. |

|

Income Tax Relief for Domestic Travel It was proposed that the special individual income tax relief of RM1,000 incurred for domestic travel expenses will be expanded to include tour packages purchased from tour agencies registered with Ministry of Tourism, Arts and Culture (MOTAC). The expenses are to be incurred up to 31 December 2021. |

|

Extension of Wage Subsidy Programme It was proposed the Wage Subsidy Programme 3.0 will be extended for another 3 months for employers who are in the tourism, wholesale and retail sectors (gymnasiums and spas), which were impacted by the Movement Control Order 2.0. The Wage Subsidy Programme 3.0 is available for applications made between 1 January 2021 to 30 June 2021. |

|

Extension of Apprenticeship Programme under PenjanaKerjaya 2.0 The SOCSO Apprenticeship Programme is a programme that provides a short-term, but full-time working experience for youths. Under the Budget 2021, it was proposed that the government will provide an incentive of RM1,000 per month for up to 3 months to private employers for each new graduate (unemployed school-leavers or graduates aged 18 to 30 years old) who participates in the apprenticeship programme. Under the PEMERKASA stimulus package, the apprenticeship programme is extended to 6 months. The improvement on the incentive is as follows:- Employers are to submit new applications and application for extension at https://penjanakerjaya.perkeso.gov.my/ |

|

Hiring Incentive under KerjayaGig Programme Incentives It was proposed that the scope of hiring incentives under Hiring Incentives 2.0 will be extended to retrenched workers and vulnerable unemployed individuals who engage in short-term employment opportunities until they are able to obtain full-time employment. Who are Eligible? Employees aged 18 – 60 years old whom are:- a)Formal workers employed and registered with SOCSO but given notice for Unpaid Leave; b)Retrenched workers registered with SOCSO; or c)Vulnerable jobseekers which include people with disabilities, participants of the SOCSO’s return to work programme, homeless, single mothers, poor head of households registered with e-Kasih database, former drug addicts, former prisoners and parolees. Types of Self-Employment or Gig Work that qualified for KerjayaGig Programme Incentive The employers or job scope applicable are organizations, platforms and establishments including e-hailing, digital businesses, any self-employment platforms that are registered with SOCSO and provides short term employment opportunities. The assistance available are as follows:-

Conditions: a)Individual must show proof of employment activities by uploading the Gig Activity and declare a minimum of 15 hours of work per week; and b)Individual who subsequently obtain full time employment must report their employment status within 24 hours to SOCSO via the PenjanaKerjaya for the subsequent incentives to be stopped. |

|

Exemption under Approved Major Export Scheme Full Sales Tax exemption will be given for trader and manufacturer who are approved under the Approved Major Exporter Scheme (AMES). The qualifying conditions are:- Trader a)Business has commenced operation more than one (1) year; b)Annual sales exceeds RM10 million; and c)At least 80% of its annual sales of its taxable goods are to be exported to overseas or transported to Designated Areas or Special Areas. Manufacturer a)Business has commenced operation more than one (1) year; b)Annual sales exceeds RM10 million; and c)At least 80% of its annual sales of exempted goods are to be exported to overseas or transported to Designated Areas or Special Areas. On 9 April 2021, the Royal Malaysian Customs Department has specified the forms required for application and exemption for AMES. Kindly visit http://mysst.customs.gov.my/ to download the latest forms. |

|

Gazette Order |

Description |

|

P.U.(A) 147/2021 |

Income Tax (Determination of Approved Individual and Specified Year of Assessment under the Returning Expert Programme) (Amendment) Rules 2021 In conjunction with the Budget 2021, the application for Returning Expert Programme incentive be extended for another 3 years. The tax incentives as follow:- a)Flat tax rate of 15% for 5 Years of Assessment; and b)Exemption on import duty and excise duty for purchase of Completely Built Up (CBU) or Completely Knocked Down (CKD) vehicle, subject to total duty exemption limited up to RM100,000. For Talent Corporation application from 1 January 2021 to 31 December 2023. |