FOREWORD

The government has introduced a phased economic recovery plan, centered on the 6R approach which is Resolve, Resilience, Restart, Recovery, Revitalise and Reform.

We are currently at Phase 5 : Revitalise. However, with increase in number of COVID-19 cases, additional efforts will be required to be carried out by the government to reduce the spread of the pandemic and revitalise the economy.

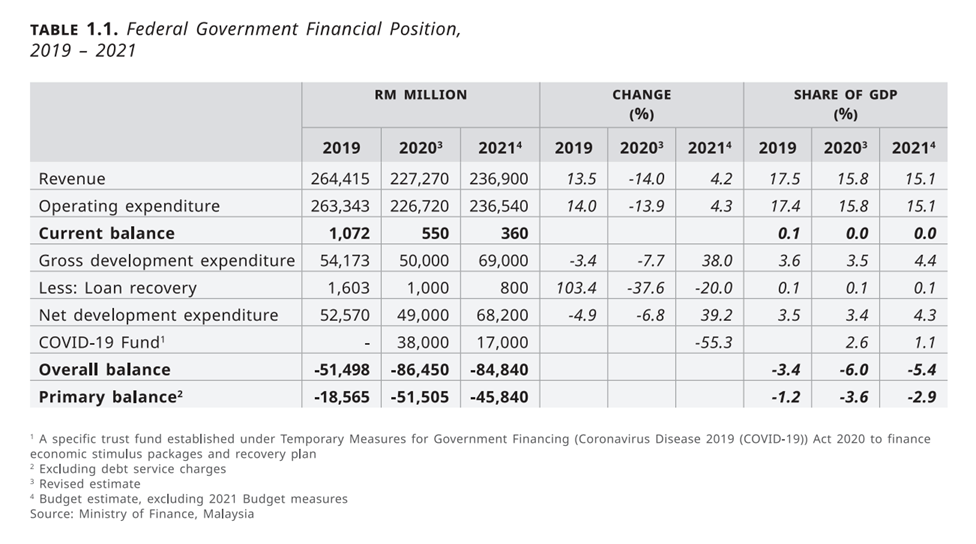

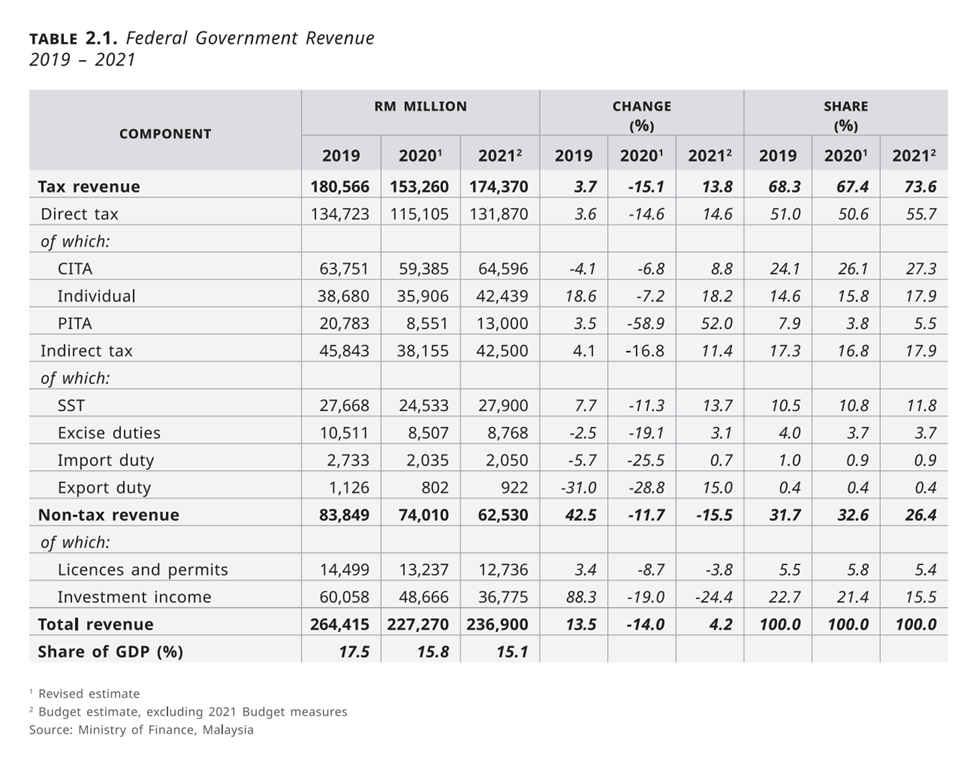

The nation’s economy suffered a tremendous blow this year. This can be seen as the government’s revenue and industry overall have been heavily impacted following the spread of COVID-19. As a result, the targeted revenue for 2020 has been revised from the initial projection of RM244.5 billion to RM227.3 billion.

Projected revenue collection for the year 2021 on the other hand, remain positive and it is expected to increase to RM236.9 billion. However, empty malls, lower exports and imports, poor consumer sentiments, low profits and rising unemployment rate towards the end of year 2020, it would be an uphill battle for the nation in the year 2021.

With a projected total expenditure of RM322.5 billion for 2021, we foresee the tax office to be more aggressive than ever.

INCOME TAX AFFECTING INDIVIDUALS

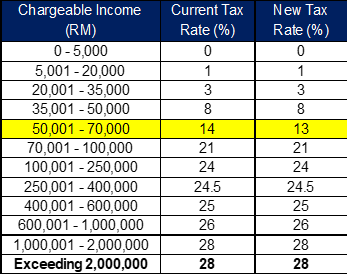

Reduction in Personal Income Tax Rate

Income tax rate for resident individuals will be reduced by 1% (tax saving of RM200) for chargeable income band of RM50,001 to RM70,000.

Effective YA 2021.

Medical Expenses for Parents

Medical expenses which include medical treatment, special needs and parental care for parents is proposed to increase from RM5,000 to RM8,000.

Effective YA 2021.

Further Deduction for Disabled Spouse

It is proposed that the further tax relief for disabled spouse will be increased from RM3,500 to RM5,000.

Effective YA 2021.

Private Retirement Scheme (PRS)

PRS relief of RM3,000 which was supposed to end in YA 2021 will be extended to YA 2025.

Expansion of Scope for Medical Expenses

It is proposed that the scope for income tax relief on medical expenses will be increased from RM6,000 to RM8,000. The amount inclusive of:-

(i)Vaccination expenses up to RM1,000; and

(ii)full medical check-up relief of RM1,000 (which was previously RM500).

Effective YA 2021.

Lifestyle Relief

Lifestyle relief of RM2,500 will be increased to RM3,000 and to include subscription for electronic newspapers.

However, the increment of RM500 is only limited to acquiring sports equipment, entrance fee / rental of sports facility and participation fee in sports competition.

Effective YA 2021.

Amount deposited to Skim Simpanan Pendidikan Nasional (SSPN) for Taxpayer’s Child

It is proposed that the SSPN relief of RM8,000 will be extended to YA 2022.

Fees for acquiring qualification at Tertiary or Post Graduate Studies

It is proposed that the abovementioned relief of RM7,000 will be extended to include up-skilling or self enhancement courses recognized by the Department of Skills Development, MOHR. The tax relief is limited to RM1,000 for each YA.

Effective from YA 2021 to YA 2022.

Compensation for Loss of Employment

It is proposed that the compensation for loss of employment of RM10,000 will be increased RM20,000 for each full year of service.

Effective from YA 2020 to YA 2021.

Tax Incentive for Returning Expert Programme (REP)

It is proposed that the REP tax incentive which enjoys :

i.income tax flat rate of 15%

ii.exemption on import duty and excise duty up too RM100,000 for acquiring a CBU/CKD vehicle

will be extended for another 3 years, for application received by the Talent Corporation Malaysia Berhad from 1 January 2021 until 31 December 2023.

Employer

Wage Subsidy Programme

It is proposed that Wage Subsidy Programme will be extended for another 3 months. The ceiling for total number of 200 employees will be increased from 200 to 500 employees.

The subsidy remains at RM600 per employee and we believe the 30% decrease in sales still needs to be complied with.

Employee’s EPF

It is proposed that the employee’s EPF contribution rate will be decreased from 11% to 9%.

Employee will need to inform the employer if they wish to retain the EPF contribution at 11%. Accordingly, the employer will need to inform the EPF Board.

Effective January 2021 to December 2021.

HRDF Levy Exemption

HRDF levies will be given an exemption for 6 months, effective from 1 January 2021. The exemption will cover tourism sectors and companies affected by the COVID-19 crisis.

Hiring Incentive

At present, the existing hiring incentive for employing a new employee receiving wages of above RM1,500 is RM800.

It is proposed that the hiring incentive will be increased to 40% of the employee’s monthly income, up to a maximum of RM4,000.

If the employee is a disabled, long-term unemployed and retrenched worker, the hiring incentive will be increased to 60%.

Training rate that can be claimed by employer will also be increased from RM4,000 to RM7,000.

Youth Apprenticeship Programme

Employer can claim an incentive of RM1,000 per month up to 3 months for new graduate who participates in the apprenticeship programmes.

Employer can further claim a grant of up to RM4,000 for training programmes for the apprentices.

Further Tax Deduction for Employment of Senior Citizens, Ex-Convicts, Parolees, Supervised Persons and Ex-Drug Dependents

It is proposed that the above tax deduction will be extended for a period of 5 years to further encourage employers to provide job opportunities for this group of individuals.

Effective from YA 2021 until 2025.

OTHER TAXES & GOODIES (maybe)

Imposition on Excise Duty on Electronic Cigarette

It is proposed that all types of cigarettes and other tobacco products will be imposed with:

i. Excise duty at the rate of 10% ad valorem for all types of electronic and non-electronic cigarette devices including vape; and

ii. Excise duty at the rate of RM 0.40 per milliliter for gel used or liquid used for electronic cigarette including vape.

With effect from 1 January 2021.

i-Lestari EPF Withdrawal

Individuals may withdraw EPF savings from Account 1 on a targeted basis. The amount allowed will be RM500 per month for a total of RM6,000 for 12 months.

However, we wish to highlight to readers to assess its pros and cons prior to such withdrawal.

Bantuan Sara Hidup will be replaced by Bantuan Prihatin Rakyat

| Household Income | With 1 child or less | With 2 children or more |

| < RM2,500 | RM1,200 | RM1,800 |

| RM 2,501 – RM4,000 | RM800 | RM1,200 |

| RM4,001 – RM5,000 | RM500 | RM750 |

| Household Income | Single |

| < RM2,500 | RM350 |

STAMP DUTY

Stamp Duty Exemption for the purchase of First Residential Home

Full exemption be given on instrument of transfer and loan agreement for the purchase of first residential home priced up to RM500,000 for Malaysian citizens.

(previously was limited to RM300,000)

Sales and purchase agreement must be executed from 1 January 2021 to 31 December 2025.

Stamp Duty Exemption for Exchange Traded Fund (ETF)

It is proposed that the stamp duty exemption on contract notes for trading of ETF will be extended for another 5 years.

Stamp Duty Exemption for Perlindungan Tenang Products

It is proposed that the exemption period for the purchase of Perlindungan Tenang products will be extended for another 5 years, to further encourage more low-income groups to have insurance and takaful coverage.

For insurance policies and takaful certificates issued from 1 January 2021 to 31 December 2025.

Stamp Duty Exemption to Revive Abandoned Housing Projects

The Existing stamp duty exemptions given to rescuing contractor/developer and original house purchaser for:-

i.loan agreements to finance the revival of the abandoned project / additional financing

ii.instruments of transfer of title for land and houses in abandoned housing projects

will be extended for another 5 years.

OPPORTUNITIES & TAX INCENTIVES

Sustainable and Responsible Investments (SRI) Sukuk Grant

It is proposed that the existing income tax exemption on grant for Green SRI Sukuk be expanded to all SRI sukuk and bond which meets the ASEAN Green, Social and Sustainability Bond Standards approved by the Securities Commission Malaysia. The tax exemption on the above grant will be given for a period of 5 years.

Principal Hub

It is proposed that the application period for Principal Hub incentive for companies undertaking qualifying services activities be extended to 31 December 2022.

Investment in Equity Crowdfunding

Individual investors who invested in equity crowdfunding is proposed to be given :-

i.tax exemption up to RM50,000 for each YA

ii.deductible amount is limited to 10% of the aggregate income

iii.investee company and amount of investment must be verified by Securities Commission Malaysia

Export of Private Healthcare Services

It is proposed that a tax exemption equivalent to 100% of the total value of the increased in exports of services will be given to companies that provide export of healthcare services.

The incentive which is supposed to end in YA 2020, will be extended for another 2 years.

Increase of Sales Limit for Value-Added and Additional Activities carried out in Free Industrial Zone (FIZ) and Licensed Manufacturing Warehouse (LMW)

The 10% limit on the sales value from value-added and additional activities carried out in FIZ and LMW to be increased to a limit of 40% of the company’s annual sales value.

Effective for new applications from 7 November 2020.

Manufacturers of Industrialised Building System (IBS) Components

The IBS tax incentive for manufacturers to be extended to 31 December 2025.

Qualifying conditions will be relaxed and Investment Tax Allowance of 60% on qualifying capital expenditure incurred within 5 years, can be set off against 70% of statutory income for each YA.

Tourism Tax

Imposition of tourism tax be expanded to accommodation premises reserved through online platform providers from 1 July 2021 onwards.

Tax Incentive for Global Trading Centre

New incentive scheme will be introduced as Global Trading Centre and to be given a 10% income tax rate for a period of 5 years and renewable for another 5 years.

From 1 January 2021 to 31 December 2022.

Tax Incentive for Relocating Operations to Malaysia

For companies which relocate its operations to Malaysia and make new investments, these tax incentives are given:-

i.New Company –Income tax rate of 0% to 10% for a period up to 10 years.

ii.Existing Company –Income tax rate of 10% for a period of up to 10 years.

Special Income Tax Rate Treatment for Relocating Non-Resident Individuals

In addition to tax incentive offered to companies to relocate their operations to Malaysia, it is proposed that non-residents holding key positions / C-Suite positions from the above, will also be able to enjoy a flat income tax rate of 15% for a period of 5 consecutive years

Effective for applications received from 7 November 2020 to 31 December 2021.