In this TaxLetter

- Updates and amendment on the following Public Rulings (“PR”):

-PR No. 8/2019

-PR No. 9/2019

-PR No. 10/2019

-PR No. 11/2019 - New PR No. 12/2019: Tax Treatment of Foreign Exchange Gains or Losses

PR No. 8/2019 Notification of Change of Accounting Period by a Company / Limited Liability Partnership (“LLP”) / Trust Body / Co-operative Society

This PR supersedes PR No.7/2011 dated 23 August 2011.

Para 5.0 : Notification of Change in Accounting Period

The amendment aligns with the new Section 21A(3A) of the Income Tax Act 1967 (“ITA”) where a company, LLP, trust body or co-operative society changes its accounting year end, the Inland Revenue Board (“IRB”) is to be notified via the Form CP204B not later than:-

i.30 days before the end of the new accounting period if the accounting period is shortened; or

ii.30 days before the end of the original accounting period if the accounting period is extended.

Para 5.2 : Company Under Liquidation

For a company under liquidation, liquidator account (Liquidator Account of Receipts and Payments and Statement of the Position in the Winding Up) must be prepared for a period of 6 months from the date of appointment of the liquidator and thenceforth, for every subsequent period of 6 months.

Therefore, a company under liquidation must furnish the Form CP204B upon the appointment of a liquidator together with a letter of appeal to the Director General of IRB to avoid compound or penalty or increase in tax payment being imposed due to failure to notify the change of accounting period within the prescribed period.

Para 6.0 : Computation of Revised Tax Instalment After Changing of Accounting Period

A change of the accounting period will result in changes in the basis period and estimated tax payable. It would result in accounting period shortened or extended. This PR added new examples of computation when such circumstances arises.

Para 8.0 : Failure to Notify Change of Accounting Period

Effective from the YA 2019, in the event that the taxpayer fails to furnish the Form CP204B within the prescribed period, the following penalty will be imposed by the IRB:-

1.10% increase due to failure to make the instalment payments under s.107C(9);

2.10% increase in respect of underestimation of tax payable under s.107C(10);

3.Prosecution due to failure to notify the DGIR on change of accounting period under s.120(1)(i) and s.21A(3A); and

4.Penalty on deemed assessment raised under s.90(3) and s.112(3).

PR No. 9/2019 Residence Status of Companies and Bodies of Persons

This PR supersedes PR No.5/2011.

The changes in this new PR No. 9/2019 are essentially to update the PR with current legislation such as replacement of franked dividend system to single-tier dividend and update on tax rates for resident and non-resident companies.

Notable additions to this PR are:

| Person | Residence status determination |

| Para 5.4 Branch of foreign entity |

Branch of foreign entity generally treated as non-resident unless it can be proved to the satisfaction of the IRB that the management and control of its business affairs is exercised in Malaysia. |

| Para 5.5 Limited Liability Partnership (“LLP”) |

A LLP is a resident in Malaysia for the basis year for a year of assessment if: (i)at any time during that basis year, the management and control of its business or any one of its businesses, as the case may be, are exercised in Malaysia; and (ii)If at any time during the basis year, the management and control of its affairs are exercised in Malaysia by its partners. |

| Para 5.6 Business Trust |

A business trust is resident in Malaysia for the basis year for a year of assessment if the trustee manager of that business trust is resident in Malaysia. The trustee manager is a resident for the basis year for a year of assessment if – (i)the trustee manager in his capacity as such carries on the business of such business trust in Malaysia; and (ii)the management and control of the business of such business trust is exercised in Malaysia. |

PR No. 10/2019 Withholding Tax on Special Classes of Income

This PR supersedes the previous PR No. 11/2018.

Removal of word “Technical” from Section 4A(ii)

The related paragraphs and examples have been amended to take into account the amendment to Section 4A of the ITA. The notable amendments are the removal of “technical” in relevant paragraphs, which put heavy emphasis on all services (whether technical and/or non-technical) rendered in connection with management or administration of any scientific, industrial or commercial undertaking will be viewed as a special classes of income, in which if such services are derived or deemed to be derived from Malaysia, withholding tax (WHT) is applicable.

Para 12.1 : Clarification on the Date of Payment where Re-grossing is Not Required for Withholding Tax Purposes

Effective from 5 December 2018 (i.e., date of publication of the PR 11/2018), in the event the WHT on Special Classes of Income is borne by a payer, the WHT is to be computed on the gross amount paid to the non-resident. The effective date refers to the date the payment has to be made by a payer to a non-resident as agreed between the parties to the agreement.

Example 22 : Late Payment on Overdue Payment

In the absence of Double Taxation Agreement, the late payment penalty which is payable to the non-resident would be considered as interest income under Section 4(f) instead of the Section 4(c) of the ITA. Hence, in such circumstance, the penalty payment will be considered as other income and subject to WHT pursuant to Section 109F of the ITA.

Nevertheless, any penalty charges for late payment would not be a deductible expense under Section 33(1) of the ITA.

PR No. 11/2019 Benefits in Kind (“BIK”)

Para 6.6 : Benefits or Gifts and Monthly Bills for Fixed Line Telephone, Mobile Phone, Pager, Personal Digital Assistant (PDA) and Subscription of Broadband

| Asset Registered under | Taxable under | Tax Treatment |

| Employer’s name (contain private usage) |

Section 13(1)(b) as BIK | The PR has contradicting treatment whereby Para 6.6 mentioned that such BIK is taxable under Formula method, but Example 20 allows exemption, limited to one unit for each asset category. |

| Employee’s name | Section 13(1)(a) as perquisites | Limited to one unit for each asset category |

Para 11 : Tax on BIK Shall Be Deducted from the Employee’s Monthly Tax Deduction (“MTD”)

Where an employee receives a BIK from his/her employment, the employer must ensure relevant MTD has been accounted for. The MTD must be deducted in the month in which BIK is paid. In cases where the salary of the employee is insufficient to absorb the MTD of the BIK, the employer is required to obtain the approval from the IRB for payment of MTD by instalments.

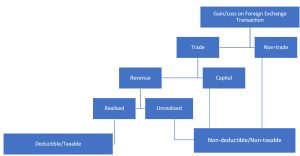

PR No. 12/2019 Tax Treatment of Foreign Exchange Gains or Losses

This PR outlines the tax treatment of foreign exchange gains or losses incurred on the various types of cross border transactions undertaken in the course of a taxpayer’s business.

In the ordinary course of a business, cross border transactions may arise when a person:-

i.imports or exports of business-related goods or services where the price is denominated in a foreign currency;

ii.has foreign operations (such as a subsidiary, branch, associate or joint venture) where it acquires or disposes assets, or incurs or settles liabilities, denominated in a foreign currency; or

iii.borrows or lends money where the amounts payable or receivable are denominated in a foreign currency.

Whether the gains of losses arising from foreign currency exchange depends on the underlying nature of the cross-border transaction.

Gains/losses on Foreign Exchange Arising from Transaction Related to Interest Income Assessed Under Paragraph 4(c) of the ITA

An exception is given if the above gains/losses arises from interest income derived from a non-trade transaction. Such amount is deductible/taxable when the amount is realized.

If you need our assistance, please contact us at admin@ancgroup.biz ; or drop us an enquiry via the enquiry form below.