In this TaxLetter

- Termination of iPerkeso

- Finance Bill 2019

- Labuan Business Activity Tax (Amendment) Bill 2019

- Employees Provident Fund (Amendment) Bill 2019

Finance Bill 2019 (version 2) was passed by the Dewan Rakyat with an amendment to proposed s.153 of Income Tax Act 1967 and Schedule 2 of Real Property Gain Tax 1976 .

Termination of iPerkeso Service

The iPerkeso portal (www.iperkeso.my) will be terminated effective 1 January 2020 for the Employees’ Social Security Act 1969 and the Employment Insurance System Act 2017.

Employers will need to adopt the new Assist Portal (assist.perkeso.gov.my) from 31 December 2019. If employers have yet to register in the Assist Portal, employers must complete the following:

1.Portal ID Registration Form (www.perkeso.gov.my/index.php/ms/portal-assist-perkeso)

2.Email the completed form to idportal@perkeso.gov.my

However, contribution payments for the Self-Employed Social Security Scheme (SKSPS) can continue to use iPerkeso.

Finance Bill 2019(version 2) on Income Tax Act 1967

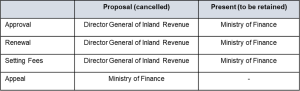

Power to approve Tax Agents’ licence

The proposal to review the power of tax agents’ licence under Section 153 of the Income Tax Act 1967 (“ITA”) has been cancelled.

Finance Bill 2019(version 2)on Real Property Gain Tax 1976

Acquisition Price for Disposal of Real Properties acquired prior to year 2013

The proposal has amended to clarify that the market value as of 1 January 2013 as the acquisition price in computing the gain arising from the disposal of real properties

acquired prior to year 2013 shall no:t apply to:-

1.Transfer of Assets to Controlled Companies (Section 34 of the ITA)

2.Disposal of shares in Real Property Companies (Section 34A of the ITA)

Effective from 12 October 2019.

Labuan Business Activity Tax (Amendment) Bill 2019

Failure to comply with Regulations

It was proposed that Labuan entity which failed to comply with the substantive requirements (minimum employee and expenditure) for a basis period for a year of assessment will be charged under the Labuan Business Activity Tax Act 1990 at the rate of 24%.

Residence Status of Labuan Entities

Labuan entity carrying on a business is a resident in Malaysia if at any time during that basis year, the management and control of its business is exercised in Malaysia; or the management and control of its affairs are exercised in Malaysia by its directors, partners, trustees or other controlling authority.

Power of Director General of Inland Revenue (“DGIR”) to conduct audit and investigation to make an additional assessment

It is proposed that the DGIR is empowered to make an assessment or additional assessment if it appears to DGIR that no or sufficient assessment has been made.

Employees Provident Fund (Amendment) Bill 2019

Election by Member to Transfer his Contributions

It is proposed that a husband may elect to transfer his EPF contributions at the rate specified below to his lawful wife/wives. The husband shall make an application to the EPF Board. After receiving such application, the EPF Board will transfer the husband’s contribution to his wife/wives on a monthly basis or in accordance with such other period as determined by the EPF Board.

| Criteria of a member of the Fund who elects to transfer his contributions | Criteria of a member of the Fund who receives the contributions transferred | Rate of contributions to be transferred |

| (a)Is a Malaysian citizen or is not a Malaysian citizen; and (b)Receives employer’s contributions on a monthly basis |

The member of the Fund is a Malaysian citizen | (2%)/(11%) x the employee’s contributions of the member of the Fund who elects to transfer such contributions The total contributions which includes cents shall be rounded to next Ringgit |

If you need our assistance, please contact us at admin@ancgroup.biz ; or drop us an enquiry via the enquiry form below.