1. Redefinition of Small Medium Enterprise (SME)

To support the growth of Malaysian SME, it is proposed in Budget 2020 that the income tax rate be revised as follows.

It should be noted that the above tax rate is only applicable to Private Limited Company (Sdn Bhd) or Limited Liability Partnership (LLP) having an annual sales of not more than RM50 million in the relevant year of assessment (YA).

| Present – YA 2019 | Tax rates |

|---|---|

| First RM500,000 | 17% |

| Balance | 24% |

| Proposed – YA 2020 | Tax rates |

|---|---|

| First RM600,000 | 17% |

| Balance | 24% |

It should be noted that the above tax rate is only applicable to Private Limited Company (Sdn Bhd) or Limited Liability Partnership (LLP) having an annual sales of not more than RM50 million in the relevant year of assessment (YA).

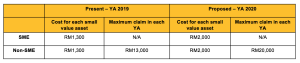

2. Accelerated Capital Allowance (ACA) on Small Value Asset

100% ACA is given to small value asset incurred for the YA 2020. It is proposed that the special allowance be enhanced as follows:-

3. Changes to Tax Penalties

Presently, a 10% penalty will be imposed on the total tax which remain outstanding after the payment due date. A further 5% late payment penalty will be imposed on the sum of tax if such amount is paid after 60 days from the due date.

It is proposed that the 5% late payment penalty be abolished via deletion of the following sections of the Income Tax Act 1967 (the Act):-

| Deleted section | Tax rates |

|---|---|

| Section 103(4) | Failure to remit tax payable after 60 days from the due date of submission of an assessment |

| Section 103(6) | Failure to remit tax payable after 60 days from the due date stated on the service of the notice of assessment or composite assessment or increased assessment |

| Section 103(8) | Failure to remit payment of tax by instalments approved by the Director of General after 60 days from the stipulated due date |

Consequential amendments arising from the removal of the above mentioned 5% late penalty will impact the following Sections of the Act:-

| Affected section | Proposed |

|---|---|

| Section 74(4) | Tax and penalties by executors of a deceased individual |

| Section 104(1)(b) | Recovery from person leaving Malaysia |

| Section 106(3) | Recovery by suit |

| Section 77B(4) | Amendment of income tax return after 60 days |

Effective : 1 January 2020

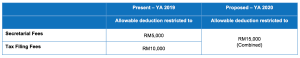

4. Special Deduction on Secretarial Fees and Tax Filing Fees

To enhance tax compliance and to ensure good governance while providing flexibility to taxpayer to claim Secretarial Fees and Tax Filing Fees, it is proposed that:-

5. Public Ruling (PR) 5/2019 : Perquisites from Employment

Public Ruling 5/2019 superseded Public Ruling 2/2013. These are the salient changes:-

| New PR 5/2019 | |

|---|---|

| Example 4 | Item received as a long service award is eligible for an exemption of RM2,000 under Para 25C, Schedule 6 of the Act. |

| Para 6.17 | Payment in lieu of Notice or Buy-Out PaymentPayment in lieu of notice or buy-out payment made by new employer to a new employee/previous employer is considered as a perquisite to the employee and must be treated as gross income from employment under Para 13(1)(a) of the Act. For example, Mr A resigned from Company A and joined Company B. Mr A supposed to serve one month’s notice prior to leaving Company A, but Company B agreed to make payment in lieu of notice to Company A for the resignation. The payment in lieu is categorized as a perquisite and is subject to Monthly Tax Deduction (MTD) / Potongan Cukai Bulanan (PCB). |

6.PR 6/2019 : Tax Treatment on Expenditure for Repairs and Renewals of Assets

| New PR 6/2019 | |

|---|---|

| Objective | The objective of this PR is to explain the tax treatment on expenditure incurred for repair and renewal of an asset from a gross income of a person. |

| Repair to restore assets to their original condition | Expenditure incurred in maintaining an asset to enable it to function properly and efficiently, is allowed as a deduction in ascertaining the adjusted income from that source. For example, A Sdn Bhd provides railway services. In 2018, the Company discovered the rails were damaged. The rails could not be repaired and instead, the Company had to replace them. The replacement is to restore the railway to its original state and not with the objective of creating a new asset. In such circumstance, the expenditure incurred for replacing the rails is an expenditure for repair and it is permissible as deduction against the gross income. |

| Initial repairs | When an asset is acquired in a state of disrepair or has not been used for a long time, and in needs of repair before it can be effectively used, such expenditure incurred for the repair is an initial expense and disallowed as a deduction. For example, B Sdn Bhd acquired a dilapidated (very run-down) shop lot. In order to use the shop lot, the Company needs to incur some repairs works. The repairs incurred to put the shop lot in the state suitable to be used is an initial expenditure, which is not allowed for deduction. |

| Replacement of entirety or part of the entirety | A repair which involves replacement of subsidiary part of the entire asset is revenue in nature, hence tax deductible. Renewals, on the other hand, is replacement of most parts of the entire asset. If renewal involves replacement of the whole asset, such expenditure would be capital in nature and thus not deductible. For example, C Sdn Bhd’s drainage system’s water gate was damaged. Water gate is a very important component of the drainage system. (a)If C Sdn Bhd replaces the water gate to ensure the proper functioning of the system as a whole which does not involve any improvement which alter the original structure/state of the system, it is revenue in nature. Therefore, deductible for tax. (b) If C Sdn Bhd replaces the water gate with an improved water gate which is significantly different from the existing water gate, such amount is capital in nature and not allowed as a deduction. |

| Replacement or Improvement | Replacement of part of an asset which is damaged is allowable as a deduction if the original structure of the asset is retained without any improvement. Where repair or replacement involves improvement which caused changes to the asset, the expenditure is capital in nature and shall not be allowed as a tax deduction. The exceptional situation is when the repair does not alter the original function of the asset, but simply restores to the original use of the asset, such expenditure shall be allowable. For example, D Sdn Bhd leased a building for business purpose. The lease agreement stated that the tenant is not allowed to make any renovation to the building except for reinstating the property. In 2018, D Sdn Bhd agreed with lessor to perform major repair works to restore the building. Such expenditure is revenue in nature and allowed as a deduction. The purpose of the repair is to enable D Sdn Bhd to continue earning profits from the business and not to create a new asset. The repair simply put the building into a state which would enable the company to continue use the building for business. |

| Implements, utensils or articles with a life span of less than two (2) years | Expenditure incurred on the replacement of implements, utensils or articles that have an expected life span of not more than two (2) years is allowed as a deduction in ascertaining the adjusted income. |

If you need our assistance, please contact us at admin@ancgroup.biz ; or drop us an enquiry via the enquiry form below.