Introduction

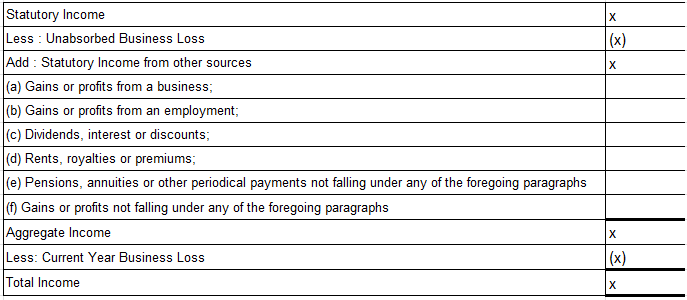

Unabsorbed business loss Malaysia — also known as UBL — allows companies to carry forward unutilised business losses from prior years to offset future business income. Understanding how UBL works under the Income Tax Act is essential for proper tax planning and compliance.

What is Unabsorbed Business Loss (UBL)?

If a company incurs a business loss in a prior year (e.g. Year of Assessment 2017), and that loss remains unabsorbed by the end of that YA, it becomes an Unabsorbed Business Loss. This UBL can then be carried forward to the next YA (e.g. 2018), and subsequent years, provided the loss has not been fully set-off. UBL can only be used to offset business income, not other sources such as employment, interest or dividends.

Current Year Business Loss — What You Can and Cannot Offset

When a company experiences a business loss within the current YA, the loss can only be set off against business income. It cannot be used to offset non-business income (e.g. employment income, interest, dividends). This ensures that only relevant revenue streams are adjusted and avoids tax mixing across income sources.

How Carry-Forward Works — Rules & Limits

| Year of Assessment | Treatment of Loss |

| YA with loss | Loss carried forward as UBL |

| Subsequent YA | UBL can be offset against future business profits |

| Forever (if never fully absorbed) | UBL continues to carry forward |

Important: UBL is only relieved when there is business income in a future YA. If all future YA produce no business profit, the UBL remains dormant until absorbed.

Example:

Consider a company with:

- YA 2018 — business loss of RM X (no business profit) → becomes UBL

- YA 2019 — earns business profit → the UBL from 2018 can be used to offset profit

If after several years the loss remains unabsorbed, it continues to carry forward indefinitely (under current rules).

Why This Matters for SMEs & Corporations

- Helps smooth cash flow during lean years

- Provides flexibility to offset peaks and troughs in business profitability

- Must maintain proper documentation and bookkeeping to claim UBL

Key Takeaways

- UBL lets companies carry forward business losses indefinitely until fully absorbed

- UBL only offsets business income — not employment, interest, dividend income

- Current year business loss same rules apply: only for business income

- Maintain clean, proper financial records for future claim

FAQ

Q: Can unabsorbed business loss offset rental income?

A: No — UBL only applies to business income. Rental income is separate and not eligible for offset with UBL.

Q: Is there a time limit to carry forward UBL?

A: Under current Malaysian tax law, UBL can be carried forward indefinitely until fully absorbed, provided the income source is business income.

Q: What if a company has both business and non-business income in the same YA?

A: UBL can only be set off against business income portion. Non-business income remains taxable under normal rules.

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.

If you need professional tax advisory services regarding the Malaysia Income Tax Act 1967, our team is ready to assist you. Contact us here to discuss how we can support your business.