Download PDF version : HERE

Tourism Tax Updates

|

Description |

|

FAQs relating to Tourism Tax Pursuant to the Budget 2021, the imposition of tourism tax shall be extended to include accommodation premises booked through online platform providers. In this respect, the Royal Malaysian Customs Department (”RMCD”) has updated the FAQs relating to Tourism Tax. Effective 1st July 2021. The salient points include:- a)Tourism tax shall be charged and levied on a tourist staying at any accommodation premises through service relating to online booking accommodation premises provided by a Digital Platform Service Provider (“DPSP”);

b)DPSP is defined as any person who provides services relating to online booking accommodation premises irrespective of the DPSP is in Malaysia or outside Malaysia. Examples given include Airbnb, Agoda, Booking.com and Traveloka.

c)Tourist are defined in the Tourism Industry Act 1992, however a tourist who is a Malaysian national (holds MyKad card); and a tourist who is a permanent resident of Malaysia (holds MyPR card) are exempted from tourism tax.

d)The rate of tax to be charged is RM10 per room per night.

e)DPSP who fails to register, commits an offence and upon conviction, will be liable to:- •Fine not exceeding RM30,000; or •Imprisonment for a term not exceeding one year; or •Both.

|

|

Tourism Tax (Amendment) Act 2021 The abovementioned has been gazette in the Tourism Tax (Amendment) Act 2021, on 2nd February 2021. |

SSM Due Date Extension under Movement Control Order (“MCO”) 2.0

|

Financial Period / |

Statutory Deadline (Circulation) |

Extension 90 days (Circulation); Or 31.03.2021 whichever later |

Statutory Deadline (Lodgement) |

Original Extension 90 days (Lodgement); Or 31.03.2021 whichever later |

|

|

Statutory deadline to: (i)Circulation of financial statements (ii)Lodge Financial Statements (iii)Hold an AGM |

01.05.2019 – 30.04.2020 |

31.10.2020 |

31.03.2021 |

30.11.2020 |

31.03.2021 |

|

01.06.2019 – 31.05.2020 |

30.11.2020 |

31.03.2021 |

30.12.2020 |

31.03.2021 |

|

|

01.07.2019 – 30.06.2020 |

31.12.2020 |

31.03.2021 |

30.01.2021 |

30.04.2021 |

|

|

01.08.2019 – 31.07.2020 |

31.01.2021 |

01.05.2021 |

02.03.2021 |

31.05.2021 |

*** Application must be submitted to SSM by 31 March 2021.

ANC Group valued clients, kindly contact our secretarial department for assistance

Tax Due Date Extension & Transfer Pricing

|

Description |

|

Filing of Returns and Tax Payments that affected by MCO 2.0 The Chartered Tax Institute of Malaysia has seek guidance and directions for taxpayers on filing of returns and tax payments that are affected by the MCO 2.0 effective 13th January 2021. The Inland Revenue Board (“IRB”) has replied in a letter dated 1st February 2021 that affected taxpayer can apply for extension of time. However, approval for extension of time will be considered based on the merits of each case by the respective IRB branch. |

|

Updates on Transfer Pricing Guidelines The IRB has updated its Transfer Pricing Documentation guidelines as follows:- Paragraph 11.2.3 With the introduction of Section 113B of the Income Tax Act 1967 which comes into operation on 1st January 2021, the Transfer Pricing Documentation should be made available within 14 days (instead of initial 30 days) upon request by the IRB. This requirement will apply to Transfer Pricing audit cases which have commenced on or after 1st January 2021. Paragraph 11.3.5 Penalty will not be imposed in cases, where:- a)Transfer Pricing Documentation is submitted within 30 days upon request by the Director General of IRB for Transfer Pricing audit cases which have commenced before 1st January 2021; or

b)Transfer Pricing Documentation is submitted within 14 days upon request by the Director General of IRB for Transfer Pricing audit cases which have commenced on or after 1st January 2021. |

Income Tax Gazette Orders

|

Gazette Order |

Description |

|

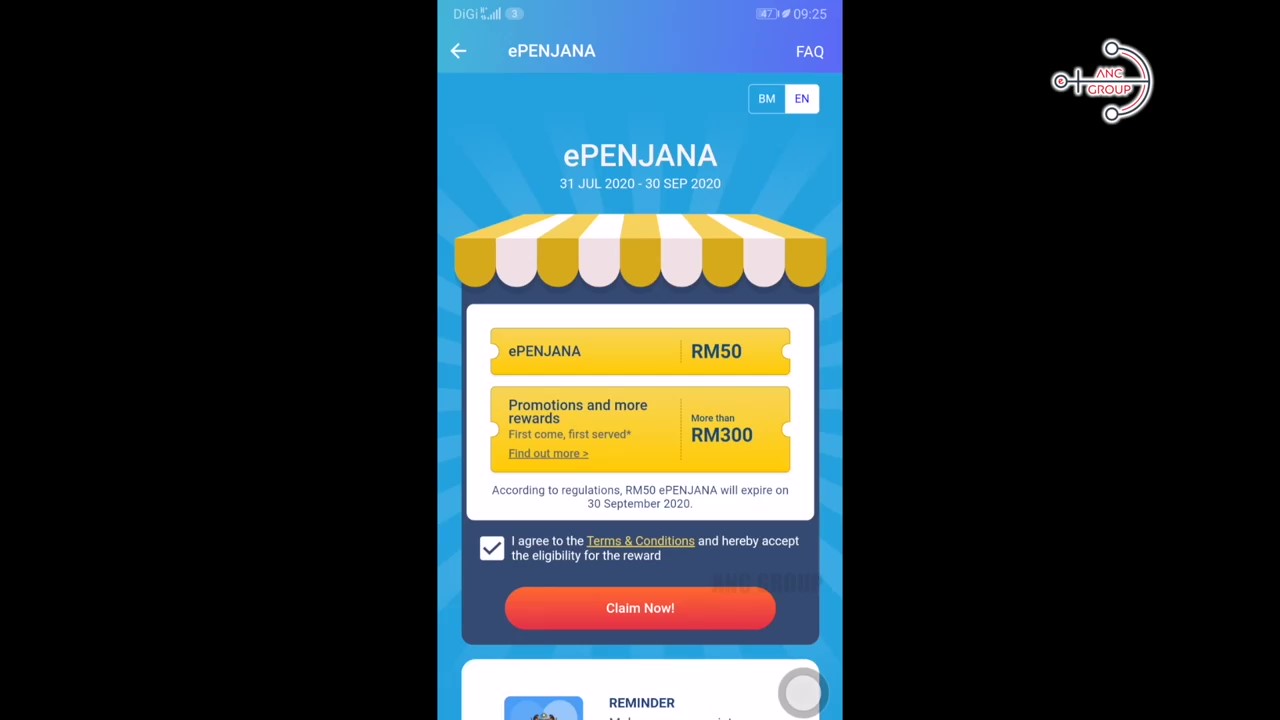

P.U. (A) 30/2021 |

Income Tax (Exemption) Order 2021 Under PENJANA, value of benefit received from the employer up to RM5,000 for the purpose of acquiring smartphone, tablet or personal computer is exempted from income tax. However, this exemption shall not apply to employee:- a)Who is a sole proprietor;

b)Who is a partner of a partnership; or

c)Who has directly or indirectly control or power to secure the affairs of the company.

This exemption is applicable for YA 2020. |

|

P.U. (A) 31/2021 |

Income Tax (Deduction for Value of Benefit Given to Employees) Rules 2021 Tax deduction shall be allowed to the company for the value of benefit given to its employees for the purpose of purchasing smartphone, tablet or personal computer. This exemption is applicable for YA 2020. |

|

P.U. (A) 47/2021 |

Income Tax (Deduction for Employment of Senior Citizen, Ex-Convict, Parolee, Supervised Person and Ex-Drug Dependent)(Amendment) Rules 2021 Additional deduction given to employer for employing a senior citizen aged sixty (60) and above, ex-convict, parolee, supervised person who is a prisoner and ex-drug dependent, has been extended to YA 2025. |