RPGT Exemption Malaysia

Under the Real Property Gains Tax Act 1976 (RPGTA), certain property disposals are treated as No Gain No Loss (NGNL) transactions, meaning no Real Property Gains Tax (RPGT) is imposed. This article explains the latest RPGT exemption Malaysia 2025 rules, focusing on family transfers, individual exemptions, and the relevant filing requirements.

1. Exemption for Transfer Between Close Family Members (Para 12, Sch 2 RPGTA)

Under Paragraph 12, Schedule 2 of the RPGT Act, the transfer of real property between immediate family members may qualify for No Gain No Loss treatment.

This means that the donor (transferor) is deemed to have disposed of the property at no gain and no loss, and the recipient (donee) acquires the property at the same acquisition price and permitted expenses incurred by the donor.

Applicable Relationships

This exemption applies where both the donor and recipient are:

-

Husband and wife

-

Parent and child

-

Grandparent and grandchild

Important:

This exemption only applies if the donor is a Malaysian citizen.

Treatment for Donor and Donee (Close Family Transfers)

| Donor | Donor’s Disposal Price (NGNL) | Donee’s Acquisition Price |

|---|---|---|

| Malaysian Citizen | Acquisition price | Donor’s acquisition price + Donor’s permitted expenses – Donee’s recovery |

| Non-Malaysian Citizen | Market value + permitted expenses – incidental disposal cost | Market value + incidental cost of purchase – recovery |

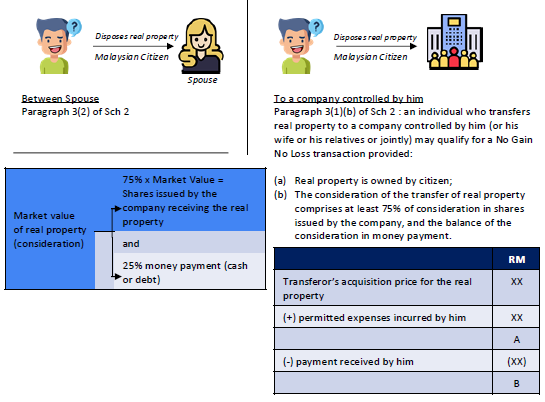

2. Individual Exemption (Para 3(1)(b), Sch 2 RPGTA)

With effect from 1 January 2018, an individual who is a Malaysian citizen may enjoy No Gain No Loss treatment when transferring a property under specific circumstances.

Applicable Scenarios

-

Transfer to a company controlled by the individual

-

At least 75% of the consideration is in shares issued by the company.

-

The balance (≤25%) may be in cash or debt.

-

The real property must be owned by the citizen.

-

-

Transfer between spouses

-

Applies under Paragraph 3(2), Schedule 2 RPGTA.

-

Disposal of real property between husband and wife is deemed No Gain No Loss if both are Malaysian citizens.

-

3. Compliance and Reporting Requirements

Both the disposer (transferor) and acquirer (recipient) must comply with RPGT reporting obligations within 60 days of the disposal date.

| Stage | Disposer (Transferor) | Acquirer (Recipient) |

|---|---|---|

| Within 60 days | Submit CKHT 1A to LHDN. If exempted, submit CKHT 1A and CKHT 3 to notify exemption. | Submit CKHT 2A and withhold 3% of total consideration (or 7% if acquirer is non-citizen/company). |

| Payment Stage | Pay RPGT within 30 days from Form K notice. Penalty applies for late payment. | Remit the withheld RPGT to LHDN within 60 days. |

| Settlement Stage | LHDN issues Certificate of Non-Chargeability or refund if excess RPGT was withheld. | Retain certificate as proof of compliance. |

Key Takeaways

- Transfers between close family members (citizens only) qualify for No Gain No Loss.

- Transfers between spouses or to controlled companies are also exempt.

- Non-citizens’ transfers are deemed at market value.

- RPGT filings must be made within 60 days even if exempted.

- Always retain CKHT forms and clearance certificates for audit purposes.

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.

If you need professional tax advisory services regarding the Malaysia Income Tax Act 1967, our team is ready to assist you. Contact us here to discuss how we can support your business.