Introduction

A qualifying research and development activity in Malaysia must meet specific criteria under section 2 of the Income Tax Act 1967. Since 28 December 2018, only activities that fulfil all requirements are considered as qualifying R&D, which entitles companies to claim R&D tax incentives.

What is a Qualifying Research and Development Activity?

To be recognised as a qualifying R&D activity under Malaysia’s Income Tax Act, the project must satisfy all the following conditions:

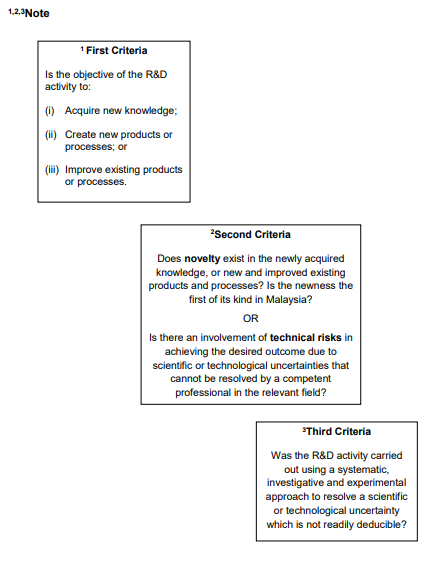

1. Objective of R&D

- Acquire new knowledge

- Create new products or processes

- Improve existing products or processes

2. Novelty and Technical Risk

The project must involve something new or carry technical risks that require resolution.

3. Systematic, Investigative and Experimental (SIE) Study

The activity must be conducted systematically in a scientific or technological field, involving investigation and experimentation.

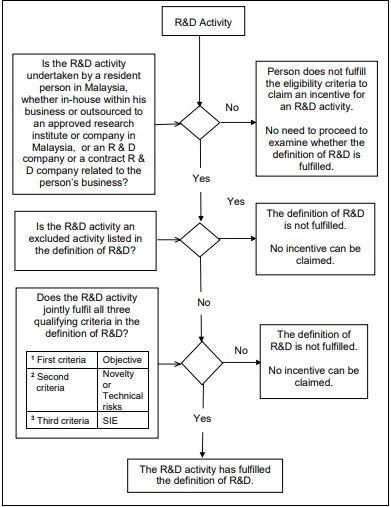

Flow Chart: Determining Eligibility

This flow chart illustrates how to determine whether an activity qualifies as R&D for tax purposes.

Commencement and Completion of an R&D Activity

Commencement Date

The commencement of a qualifying R&D activity refers to the date the specific project starts.

Completion Date

The completion of an R&D activity is when prototype testing is completed or when principles of a new production process are established.

Duration of R&D Activities

The duration of an R&D activity may extend across two or more basis periods, as long as it continues to fulfil the qualifying criteria.

Key Takeaways

- Qualifying R&D must meet all ITA requirements.

- Objective: acquire knowledge, create, or improve processes/products.

- Must involve novelty, technical risk, and SIE study.

- Commencement = project start date; completion = prototype or process established.

- Activities can span multiple basis periods.

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.

If you need professional tax advisory services regarding the Malaysia Income Tax Act 1967, our team is ready to assist you. Contact us here to discuss how we can support your business.