[vc_row][vc_column width=”2/3″][vc_column_text][/vc_column_text][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Indirect Tax Updates

- Sales or Service Tax Payable extended to 15 April 2020

- Import Duty and Sales Tax Exemption on Face Masks

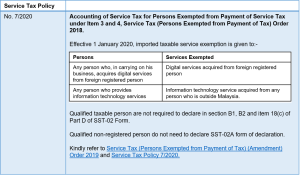

- Service Tax Policy 7

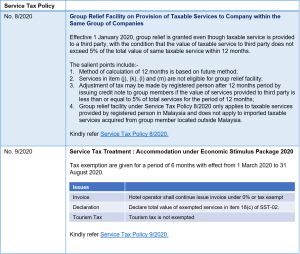

- Service Tax Policy 8

- Service Tax Policy 9

RMCD during Restriction Movement Order

Royal Malaysian Customs Department Operation and Services during Restriction Movement Order

To curb the Covid-19 pandemic, all government premises will be closed except for those which are related to Essential Services. Kindly refer to our summary in TaxLetter 22.

The deadline for submitting tax returns which includes tourism tax, sales tax and service tax is extended to 15 April 2020. Full penalty remission will be provided to returns submitted before 15 April 2020.

Please take note of the due date which defers from our earlier TaxLetter 22.

Kindly refer to RMCD full guideline HERE.

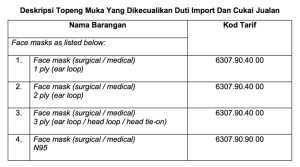

Import Duty and Sales Tax Exemption on Face Masks

Import Duty and Sales Tax Exemption on Face Masks

The Ministry of Finance (MoF) has exempted specific types of face masks from import duty and sales tax, effective 23 March 2020.

The exemptions are in accordance to s.14(2) of the Customs Act 1967 and s.35(3)(a) of the Sales Tax Act 2018. The types of face masks given exemption are:-

Service Tax Policy 7/2020

Service Tax Policy 8/2020 & Service Tax Policy 9/2020

[/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]