简介

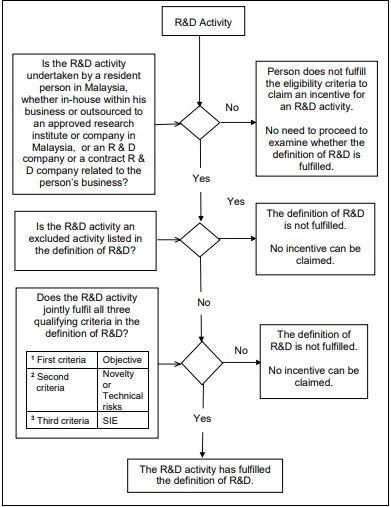

在马来西亚,一项 符合资格的研究与开发活动 必须满足《1967年所得税法》第2条下的标准。自2018年12月28日起,只有完全符合条件的活动才被视为合格R&D,可享有税务优惠。

什么是符合资格的研究与开发活动?

根据马来西亚《所得税法》,R&D必须满足以下条件:

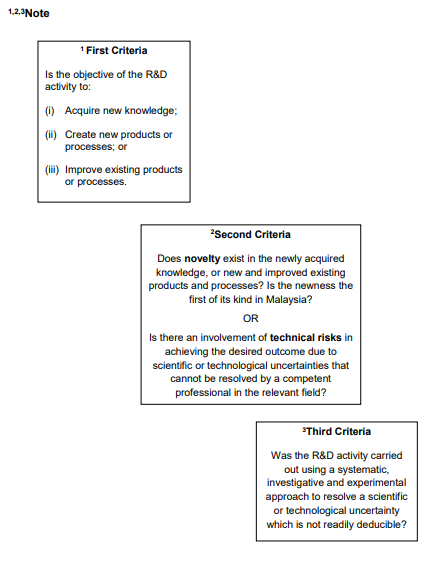

1. R&D目标

- 获取新知识

- 创造新产品或新流程

- 改良现有产品或流程

2. 新颖性与技术风险

项目必须涉及新的元素或存在需要解决的技术风险。

3. 系统性、调查性和实验性研究 (SIE)

活动必须以系统性方式进行,并涉及科学或技术领域的调查与实验。

资格判定流程图

在此放置流程图图片

R&D 活动的开始与完成

开始日期

指具体R&D项目正式启动的日期。

完成日期

指完成原型测试,或成功确立新生产流程原理的日期。

R&D 活动的期间

R&D活动可能会跨越两个或更多的课税期间,只要持续符合资格条件。

关键要点

- R&D必须符合《所得税法》的所有条件。

- 目标:获取知识、创造或改良产品/流程。

- 必须包含新颖性、技术风险和SIE研究。

- 开始日=项目启动;完成日=原型或流程确立。

- 可跨越多个课税期间。

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.

If you need professional tax advisory services regarding the Malaysia Income Tax Act 1967, our team is ready to assist you. Contact us here to discuss how we can support your business.