简介

马来西亚的支出与费用规定决定了哪些企业成本可以扣税。理解可扣税与不可扣税的费用、费用的应计,以及相关案例法,对于正确遵守税务规定至关重要。

允许扣除的项目

可扣除的费用包括:

- 借款利息

- 应付租金

- 与场所、厂房、机器或固定装置的修理费用

不允许扣除的项目

以下属资本性支出,不允许扣除:

- 资产的更换

- 增强或改善

- 初始维修(资产使用前的大规模维修)

📚 Case: Federal Commissioner of Taxation vs James Flood Pty Ltd

- 费用即使未支付,只要纳税人已承担义务,也视为已发生。

- “Incurred” ≠ “Provision”。Provision 属于不确定性,可能被冲销,因此不算支出。

费用的应计

费用在权责发生制下可扣除,即使尚未实际支付。

📚 Case: Exxon Chemical (M) Sdn Bhd vs KPHDN

- EC 为员工设立退休及离职福利计划,拨出 RM881,270(YA1986–1991)。

- 税务局不允许扣除。

- 上诉法院判决:只要员工服务超过 11 年,享有既定权利 → 属于“完全且专门”支出 → 可扣除

特定允许利息 [s.33(1)]

利息支出可扣除,条件是:

- 贷款用于产生收入;或

- 贷款用于购买、持有在当期用于产生收入的资产。

关键要点

- 可扣除:利息、租金、维修费用

- 不可扣除:资本性支出(资产更换、改善、初始维修)

- 权责发生制原则:费用在负担义务时即可扣除

- 案例法:James Flood、Exxon Chemical 解释了相关规则

- 利息支出在 [s.33(1)] 下允许扣除,若与收入生产有关

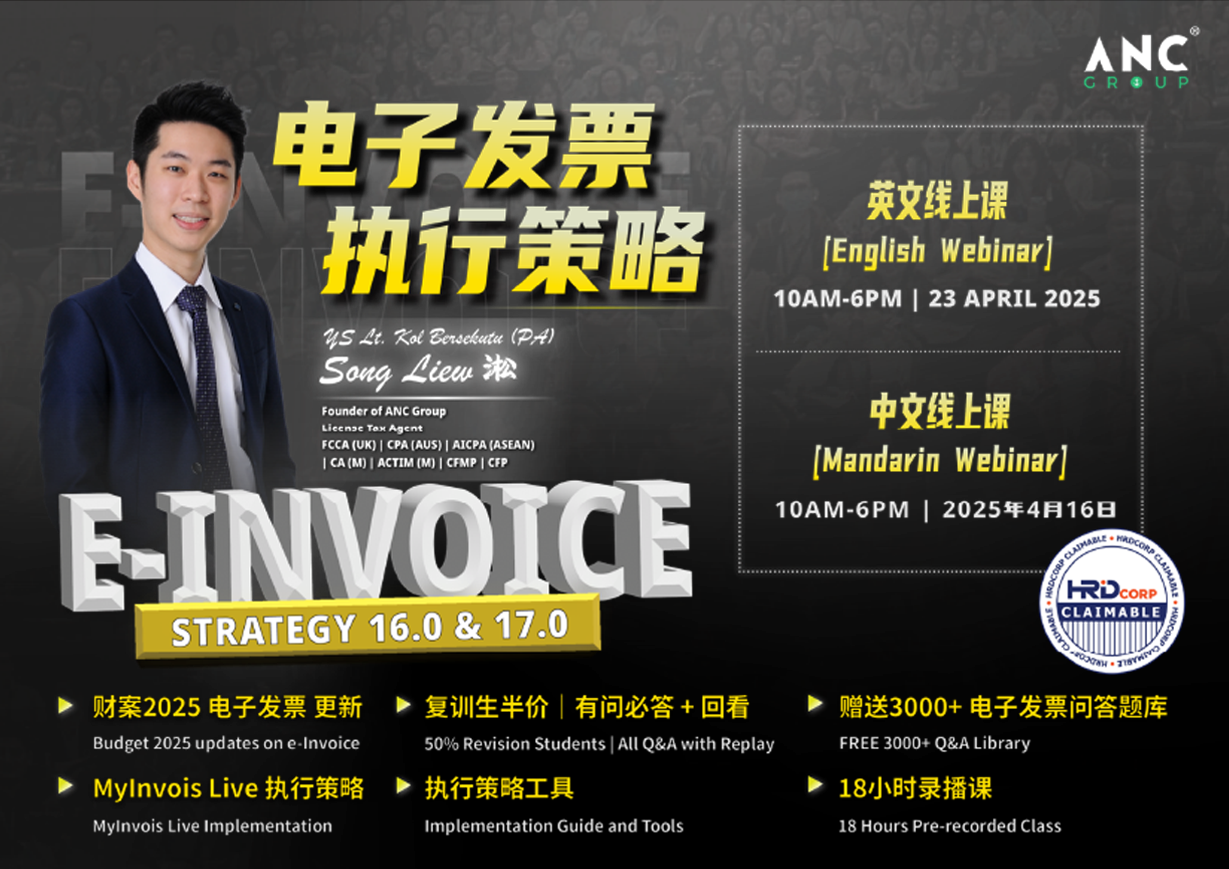

ANC Group – Your Personal Tax Advisor

Tax consulting is the core service of ANC Group. Our tax professionals provide clients with comprehensive tax support and guidance. We offer tax consulting and compliance services for expatriates, entrepreneurs, and listed and non-listed companies.

Our tax consulting services include business tax, transaction tax, personal tax, and corporate income tax. We don’t just guide you in interpreting and applying complicated taxation rules, but to explore new opportunities and business trends.

ANC Group keep you abreast with Malaysia tax updates and any changes in the local regulations.

We work closely with industry specialists, authorities, and associated professionals within ANC Group to provide the best-in-class integrated tax planning solutions. ANC specialists coordinate the accounting and taxation services to bring your business to success.

If you need professional tax advisory services regarding the Malaysia Income Tax Act 1967, our team is ready to assist you. Contact us here to discuss how we can support your business.